A report by Nucleus Commercial finance revealed some promising results for International Women’s Day.

The report found that almost half of UK employees work for a company with a female CEO or Managing Director. Nearly 63% of female respondents feel their company supports female leaders and encourages female staff to pursue leadership roles.

These results are said to be a development of previous targets set by the government to achieve more than 33% of board positions at FTSE 100 and FTSE 250 firms being held by women by the end of 2020.

Some progress has been made in closing the gender gap. However, while the study results are encouraging, CEO Chirag Shah warned of complacency. “While we are seeing positive improvements when it comes to women in business, there is still major work to be done to achieve total equality.”

“Recent reports have shown female entrepreneurs in the UK launch their businesses with 53% less capital than men. A lack of access to funding is one of the biggest challenges they face when deciding to start their own company, as opposed to men.”

In response to their recent findings, Nucleus Commercial Finance has announced the introduction of loan discounts to companies with a female director.

“Our ambition is to encourage businesses with female leaders to maximize their potential and ensure they are doing so with the appropriate financial backing in place. It’s by no means a silver bullet, but hopefully a step in the right direction,” said Shah.

Female-led teams face chicken-and-egg situations

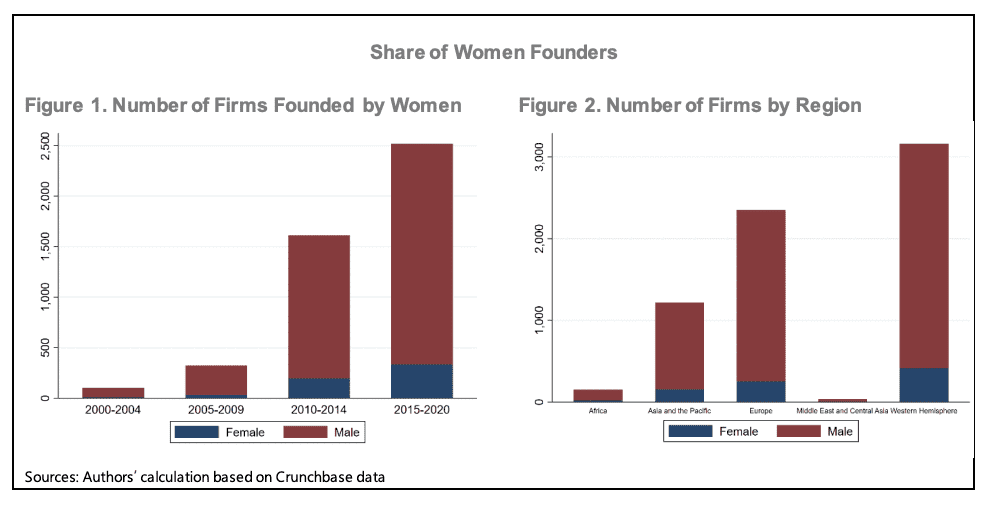

Finance and the tech sector have been notoriously resistant to closing the gender divide, sometimes to institutions’ detriment. Dealroom’s study for the Department for Science, Innovation, and Technology showed that UK tech startups with at least one female founder had received increasing amounts of funding over the past two years, up 700 million between 2021 and 2022. However, while things have been improving, still only 9% of UK tech unicorns have female founders.

The IMF found that women hold less than 25% of board seats in banks and bank supervision agencies, accounting for about 5% of bank CEOs globally. They found this to have economic and financial implications, and there is evidence that more women on banking and supervisory boards could equate to more bank stability.

In fintech, women represent less than 10% of leadership, rising slightly for newer firms.

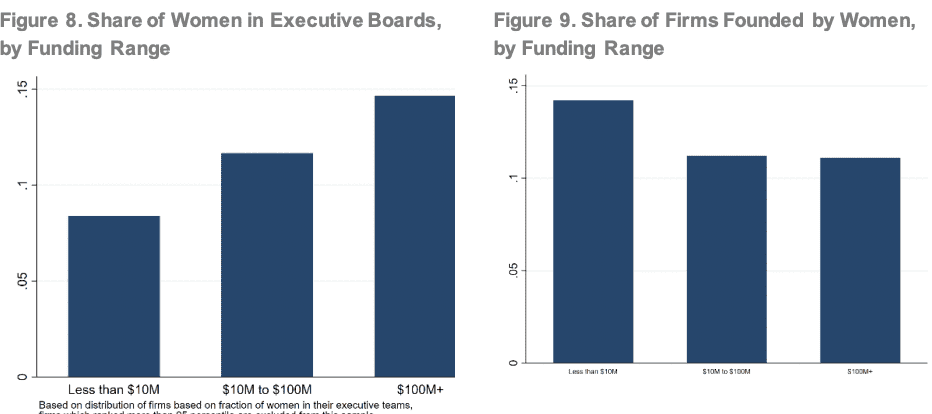

The IMF’s global report on fintech found that, like banks, the higher number of women on executive boards had equated to higher amounts of revenue, but the opposite was found for all female leadership teams. Both funding and company size was also seen to decrease in companies led solely by women, but for mixed teams were seen to rise.

The results pose conflicting evidence that could be taken in several ways. While there was substantial evidence for a positive relationship between board diversity and performance, the IMF felt that the drop in revenue associated with female-led companies could cause investors to perceive female-led entities as higher risk.

However, associated drops in company size and access to funding could create a scenario of the chicken and the egg – less funding equates to less initial growth in the company and, therefore, less revenue.

The study noted several elements could influence the gender gap in funding.

“In our findings related to firms founded by women getting less funding than those founded by men,” stated the report. “First, experimental literature finds that women invest less and appear more financially risk-averse than men. Second, the gender bias of investors funding projects may have a role to play.”

Representation could be vital to closing the divide. The report explained that multiple studies had found that investors had changeable attitudes according to the gender of the firms’ leadership teams. Male investors seemed to show more interest in male founders, while there was evidence for female investors favoring woman-led teams. This could affect interest in funding allocation, and the parameters that companies looking for funding were assessed by.

Related:

With a global squeeze on fintech funding, the investment landscape is bleak, even more so for all-female teams. However, experts remain tentatively optimistic about the small gains on the issue.

“Attention has been repeatedly drawn to the dearth of funding for female-founded businesses, so it is good to see a significant number of UK companies raising mega-rounds and the progress made by female-founded companies across the board,” stated Yoram Wijngaarde, founder of Dealroom.

“However, there is still a huge gap to be made up since the vast majority of startups and funding continues to go to all-male teams. By focusing on this metric and upskilling talent across the digital tech sector, we should be able to make a difference.”