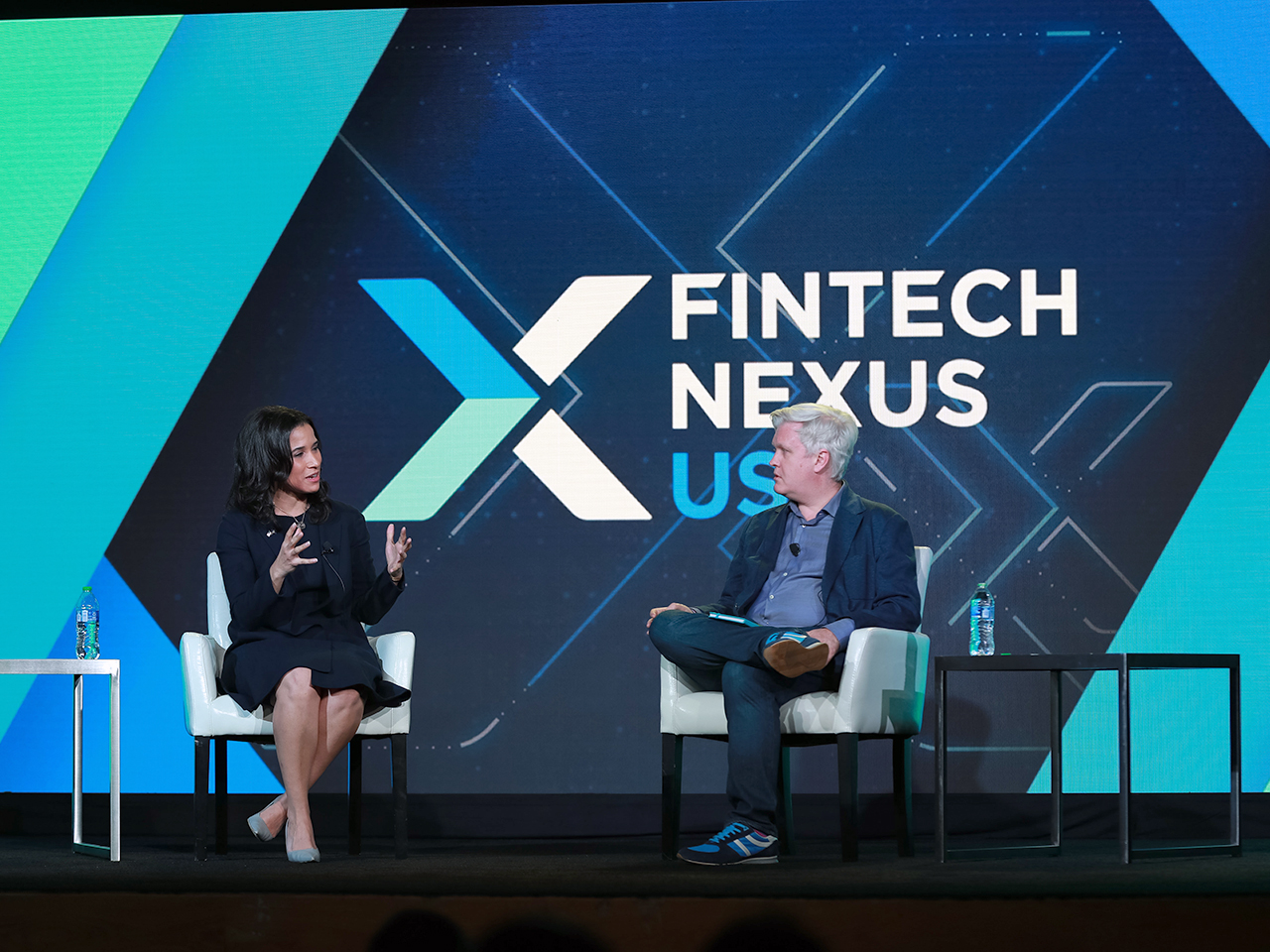

In this keynote address, the Superintendent of the Department of Financial Services (DFS), Adrienne Harris, spoke with Garry Reader, CEO of the American Fintech council, on how her department has taken a leading role in fostering innovation in the state of New York.

They discussed if fintech could live up to the promise of financial inclusion and state regulators’ role.

In recent times the DFS has shown that supporting innovation is critical to a healthy financial system. Tasked with regulating some of the world’s largest financial institutions and a growing community of fintech startups, the DFS wants to send the message that regulators should not shut down innovation before it can help people.

Here are our top seven takeaways:

1. New york has been a history of regulating digital currencies

“New York State has led the way in virtual currencies as a regulator,” Harris emphasized.

The city has an extensive yet innovative history in regulating digital currencies. There was an emphasis on New York being a leader in the space, “going back as far as 2015.” The conversation surrounded the incremental steps the DFS has taken toward creating a rigorous framework and the future looking at what is possible to keep New York at the center.

Speaking on bid licenses, Harris expanded.

“Historically, it’s taken a very long time to get the license, and it’s no secret. So we’ve done work to increase the efficiency of the licensing process without sacrificing the regulatory rigor that the space demands. And I think, as the federal government starts to think about this, we’re working closely with federal regulators, with international regulators to lend our experience to their efforts.”

2. New York has high standards in regulation

The fact remains that New York’s regulatory framework focuses on ensuring standardization, auditing, and rigorous attention. Here the conversation looked at fintech regulation in comparison to banks.

By creating a data drive approach in their practices internally and externally, the DFS is attempting to tailor financial services and products to work for the future. A key area here is operations, honing in on leadership skills, and the “war on talent.”

Harris explained, “DFS has been regulating the space for a long time, both through our bid license and our limited purpose trust charter. It’s an incredibly rigorous framework that we have. We have the same standards as we have for our banks and the same cybersecurity standards as we have for our banks. And so, you know, we look at the space and take a rigorous approach to stablecoin. We require one-to-one reserving with cash and cash or cash equivalents. For every token on-chain, we require third-party attestation of the reserves. And we require internal and external auditing of the reserves. So the standards are incredibly high.”

Related:

When looking at operations, Harris argues it is about “processes on the licensing side and supervision more standardized, more efficient, without sacrificing the rigor leadership, we’ve brought in some fantastic talent. And it is a war for talent, especially in the crypto space. But we’ve brought in 15 new people to that unit alone, and we’re going to bring in a couple dozen more, at least this year. That’s the goal. And then technology. As I mentioned, we are using technology to supervise the space. So there will be much more from DFS on virtual currency.”

3. Climate change

A discussion about how climate risk overlaps with financial services was an interesting one that Reader brought up. An economic and moral argument was made for significant increases in climate finance and the role that financial services will play.

“We are talking to our regulated institutions about their own operational resilience. Where is your building? Is the generator on the roof and not in the basement? Right? Can you think about ways of making your building more sustainable? And that’s not a part of the regulatory framework. Still, it is part of the discussions we have with our entities, and I think a good use for our soft power and our convening power to start talking with our regulated entities about that stuff.”

Harris discussed her role in creating a climate division, mitigation governance, and the tension between climate policy and financial services.

“One of the first things I did when I came into the office, even before confirmation, was to create a standalone climate division. It’s the first of its kind of any regulator. The department had already done climate guidance for insurers. We’re now finalizing some climate guidance for banks and mortgage lenders. But to your point, this is not an AI ideological exercise focused on risk mitigation governance. This is really about the data. This is about safety and soundness, consumer protection, and risk mitigation. But one of the things I think that goes underappreciated is the tension between climate change policy, financial services, and fair lending mandates. We know that low and moderate-income communities of color are disproportionately impacted by climate change.”

4. Discrimination in unfair lending

Expanding on the conversation on inequality, Harris took a personal touch as she explained discrimination in the regulatory system and unfair lending, looking at historical issues affecting her community and more recent challenges such as the pandemic.

“When I think about issues around discrimination by U.S. Fair Lending. For me, it is personal. And I think about my family. I think about my mother, who grew up in the housing projects in the Bronx. I think about my father, who grew up in segregated Baltimore, and some of the things they faced. I think about my family. They say, how do we make sure that when we are making policy when we are writing rules, when we’re bringing enforcement actions that we’re doing so with those people in line, so much of our job is about protecting the marketplace, and protecting the safety and soundness of institutions and making New York a great place to do business, which I think it is.”

The conversation focused on financial institutions’ need to drive talent that reflects the population it services—creating a fair, defined process to assess risks and potential discriminatory outcomes of all activities.

“When you think about diversity, somebody who’s been in several sectors, somebody who’s of color and is thinking about the people who use the services, most tend to be of color, I was able to say, like, we’re not, we’re not doing it, I’m not doing this, I’m not increasing this fee. And not only did we freeze the fee, but then we went back and devised a new methodology that we’ve proposed through the notice and comment period and in a new regulation, but I think it takes diversity in the broadest sense of the world to Word to kick the tires and bring a beginner’s mind to things,” Harris adds.

“The pandemic created systemic inequities that have been revealed to some but that many of us already knew existed. And I tell people my goal is not to get back to pre-pandemic because it wasn’t all that good. Right? When you think about systemic inequities, it’s not like we were living in some utopia, pre-pandemic.

5. Balancing consumer protection, investors, and regulators

Reader brought up an interesting topic: striking the right balance between consumer protection, investors, and regulators. Innovation remains at the forefront of DFS. However, the population is behind in financial literacy. Harris used crypto as an interesting case study here. The focus of the DFS is on creating productive discussions in this space.

Harris explained, “we want innovation, new products, new ways for people to access credit safely and affordably. We want new insurance products that meet people’s needs, whether your phone, a trip, your pet, or more traditional things like your home or your life. And so that innovation is excellent. But it would help if you had balanced consumer protections with financial health and financial literacy. And I think as a regulator, you don’t want to front-run the innovation. We are a capitalist society. So it’s not your job to front-run innovation. But, nor can you lag behind it for a decade. Plus that, especially with speed with the space that’s moving. Now we think about crypto. It changes every day. So you can’t afford to be a decade behind. You can’t be five years behind. Right. So it’s about that it’s about finding that balance in time, as well. But I think that goes back to what we think about a DFS is how we engage and have productive discussions. And we have an open-door policy where we invite companies to come in, not just when they have a license pending, not when there’s some issue that we’re working through together. But come in, tell us your view of the space. Tell us, you know, what we should be thinking about next. Sometimes it’s even helpful when you tell us we don’t think you should be thinking about that space.”

6. Importance of data for the future

As expected, purpose-driven data was an essential topic of conversation. Harris emphasized the need to look for the “right” data for resiliency, a collaborative approach with many stakeholders. This remains important when considering historical risks such as unfair discrimination and anticipated risks such as climate change.

“I see my role, our role as taking a data-driven, evidence-based approach. Most of what we do requires a scalpel and not a hatchet. So when we think about things like artificial intelligence and fintech, more broadly earned way to access Buy now pay later, it cannot be all this innovation is great and perfect and wonderful. The world will be better off. This is all terrible and all predatory, and we throw the baby out with the bathwater. I think we have to acknowledge both the benefits and the risks. We have to engage with stakeholders, advocates, legislators, industry, academics, you know, other regulators, and try to identify what are the business models we think are safe and transparent and affordable and serve a need versus those business models that are predatory and opaque and don’t serve a need. And as I said, that requires a scalpel, not a hatchet.”

“We must be using the data, right, that as a regulator. We’re using the data that computing power that we now have available to us that wasn’t available 10 years ago.”

7. Importance of macroeconomic context

There was an underlying narrative that macroeconomics is essential in understanding fintech and building the infrastructure to support different types of value propositions from large financial institutions. Harris highlighted issues such as the pandemic, the Ukraine war, and widening inequality in the U.S. and beyond.

Harris explained, “given the changes that we’re seeing, especially now, post-pandemic and the macro context, macro economic context, it’s given me this perspective to think about how do you build a transparent, resilient, equitable financial system through the lens of a future-looking data-driven modern regulator.”

“And in the wake of the war, starting in Ukraine, we had procurement for our blockchain analytics tool. So we, the regulator, are using those technologies to regulate. And we’ve got many goals for the space. We have an internal initiative we call volt. For vision, operations, leadership, and technology.”

The post Fintech Nexus USA 2022: Top lessons learned in role of NY DFS in fostering financial education appeared first on News.