After two months of market chaos, industry keeners wonder: will decentralized finance (DeFi) eat the traditional finance world?

Fintech Nexus co-founder and CEO Bo Brustkern sat down with Liz Mathew, Global Head of Business Development & Partnerships at Web3 wallet market leader ConsenSys, to talk DeFi adoption at Fintech Nexus USA 2022 at the Javitz Center in New York City.

“I run business development and partnerships for MetaMask Institutional, which is the institutional fork of the retail wallet,” she said.

Describing the MetaMask Wallet, she said it dominated a 95% market share of browser wallets, stopping short of calling MetaMask a household name in Web3.

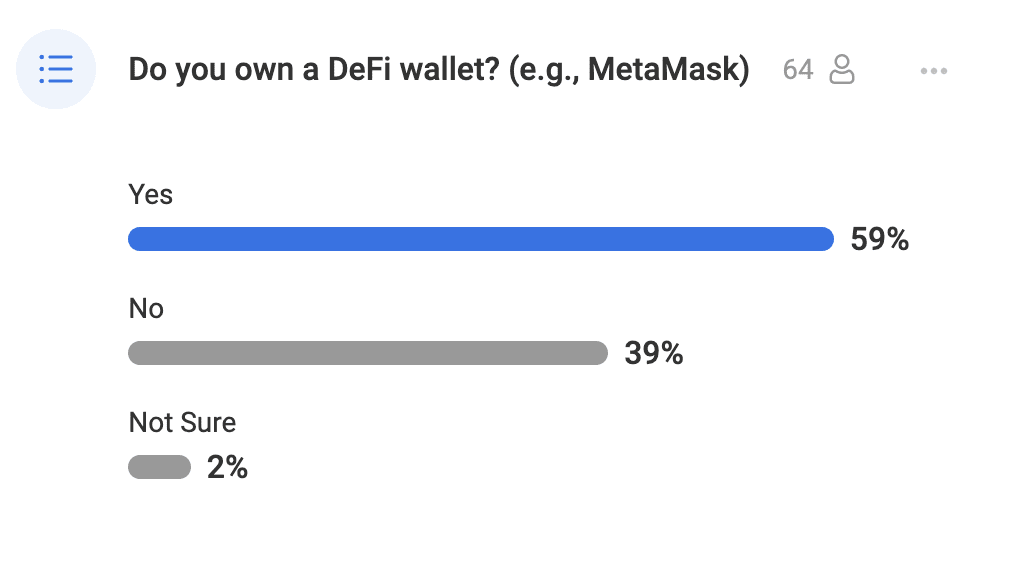

While Brustkern and Mathew talked about DeFi’s adoption, Brustkern posed questions to the crowd. Fintech, venture capital, banking, and credit union audience members answered polls covering their interaction with DeFi, showing that most had dipped their toes into the Web3 space.

Mathew also spoke with Brustkern during the Crypto Winter Podcast on Wednesday, July 17.

‘Inherently open source’

Mathew said the ecosystem had evolved since she joined the firm in 2021.

There are an estimated 17,000 ways to interact with DeFi or Web3 through browser wallets like MetaMask, the majority built in the past two years.

“You can buy, sell, lend, borrow, stake, hedge, swap NFTs, lend them out, all kinds of quirky things,” she said. “Over the last two years, because of the inherently open source nature of decentralized finance and Web3, you’ve had about 17,000 protocols develop in the ecosystem.”

She said that new transaction opportunities would replace a slow, centralized, traditional finance system; despite facing volatile markets and industry lending catastrophes, the new ways to trade are not going away.

“Practically overnight, we’ve gone from a paradigm where you had two dozen broker-dealers or syndicate desks in traditional capital markets as the original purveyors of financial engineering. They were the people responsible for creating and distributing financial risk,” she said. “You now have tens of thousands of open-source protocols to access liquidity and execution and risk profiles, some of which we’ve just not seen in traditional markets.”

“This is where I get excited when I hear a proper expert in the space use a blend of language that is coming from DeFi and TradFi, which have their own language; this is where we are heading,” Brustkern said.

Even within a crowd of banking and traditional finance experts, the poll showed that most reported owning a DeFi wallet and interacting with the DeFi ecosystem.

The work is cut out for DeFi Advocates

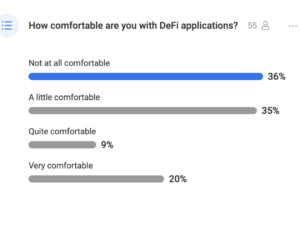

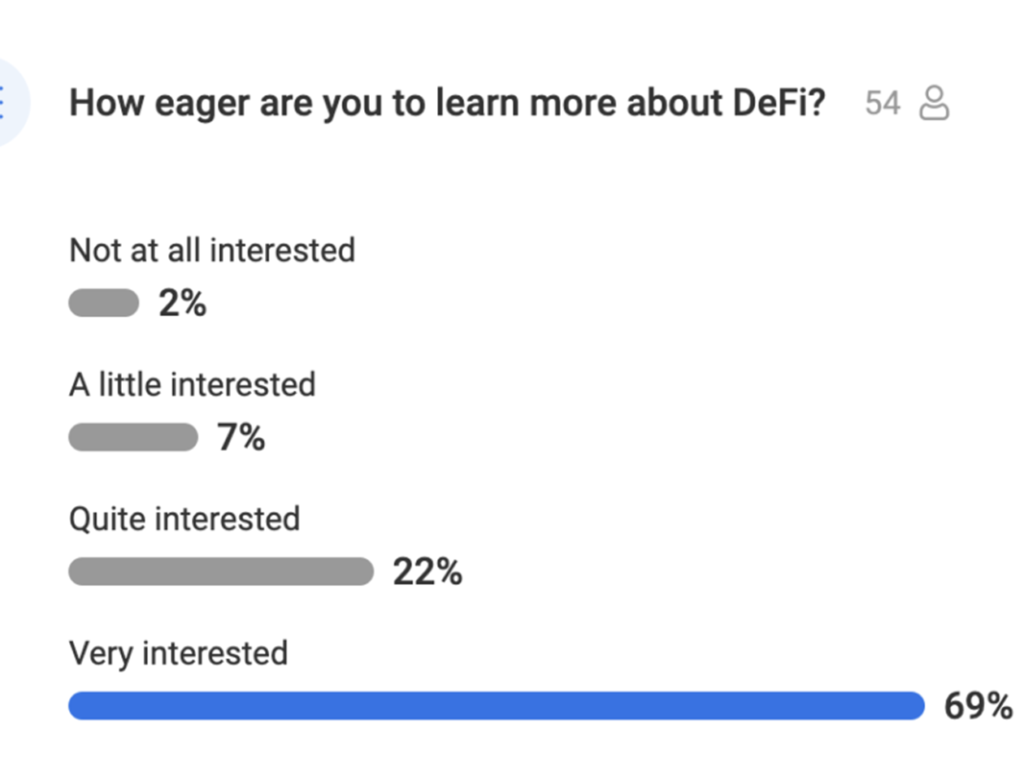

Even with a surprising adoption rate at a fintech-focused conference, the vast majority that responded in the crowd stated they were not comfortable using DeFi and would like to learn more about it.

“Our work is cut out for us,” Brustkern said, describing Fintech Nexus’ position as an industry content and education platform.

“Yeah, we have a lot of work to do at ConsenSys; 20% of you report yourselves as being very comfortable. And then there’s a little segment 10% that said quite comfortable,” Mathew said.

Will DeFi and Tradfi depend on one another?

Brsutkern asked the ultimate question; will traditional finance and DeFi depend on each other, and will the dominance of conventional finance firms like banks maintain their position in the future.

“Yes,” Mathew said. “I think it was Bill Gates that said, ‘people tend to overestimate the amount of change they will see over the next two years and underestimate the change over the next 10 years.’ In the first two years of my involvement in this industry, I spent a fair amount of time working with the most significant investment banks.”

She gave examples of trying to solve settlement issues in the bond issuance cycle, saying that there are many problems a private permissioned ledger like a blockchain could solve.

“If you’ve ever had the pleasure of reading the documentation at the DTCC that defines how a coupon payment pays out, you’ll very quickly understand that it’s not the right way to be thinking about such a disruptive innovation,” she said.

“On one hand, you’ve got cost structures that prohibit the largest financial institutions from servicing a majority of funds or institutions,” she said. That is traditional finance, but in DeFi, “you as an individual can go and stake your eth in a liquidity pool and receive daily rewards in your digital wallet.”

Building traditional finance and DeFi separately ‘waste of energy’

“I think it would be a waste of energy to try and solve for the interdependencies of both worlds because there’s so much that needs to be solved for the core user,” Mathew said. “I speak to almost 50 funds a week at this point globally that say we are using a spreadsheet, a hardware ledger device, and the retail wallet to make sense of our portfolio today.”

Mathew said because institutions use a consumer wallet to track their portfolios, ConsenSys has to bridge the retail and institutional gap while building its project teams. That is why last October, the firm launched MetaMask Institutional. The demand for an enterprise wallet to track DeFi and more was there.

Related:

“We have a tool called Infura, an API SaaS service used by 430,000 developers globally today. But our normal wallet, we have MetaMask, which we think of as the ultimate gateway to defy at the retail and institutional level,” Mathew said. Most devs and companies still used the MetaMask standard wallet, so OCnsensys saw an opportunity.

“Because of the strong product market fit that we see adoption for MetaMask Institutional, we launched in October; we’ve onboarded 300 organizations since then. I think what this tells me is that we were raising the bar in terms of defining a category in itself for defy institutions.”

The post Fintech Nexus USA 2022: Will DeFi destroy the world or own it? appeared first on News.