It’s debatable which could be considered the buzzword for the financial sector of the 2020s, but “crypto” and “ESGs” are strong contenders.

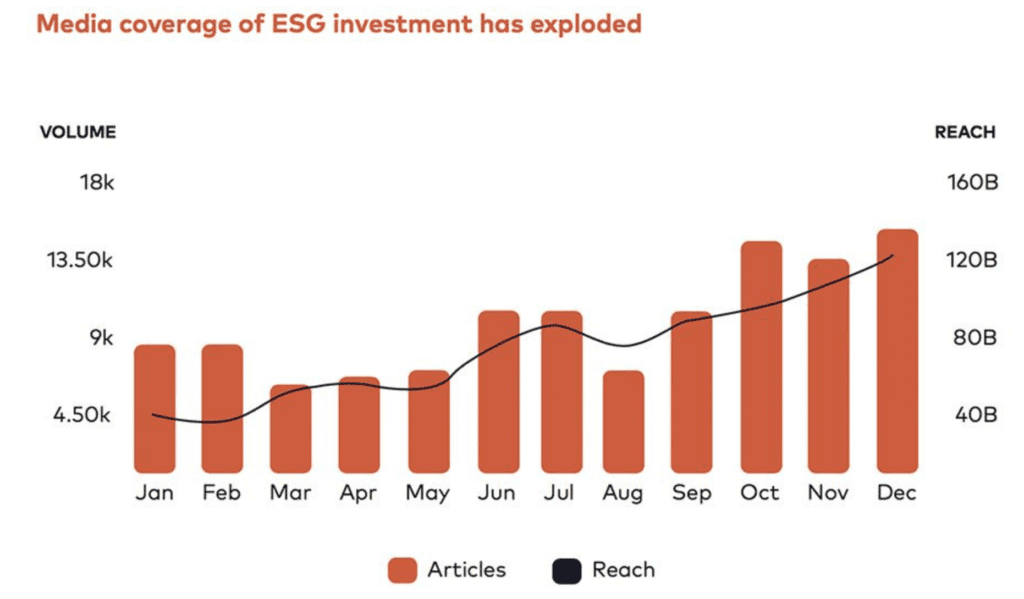

In 2020, media coverage of ESG investment increased by 75%. Although nothing compared to the wild, sexy renegade in the crypto sector, attention has been sparked, with the prolonged effects of environmental degradation holding the public eye.

This month the highly publicized ethereum merge brought the buzzwords together (they, too, merged). Many news outlets highlighted the environmental impact of the blockchain’s shift to Proof of Stake and compared bitcoin’s energy consumption to whole countries. The figures are shocking, and even regulatory bodies are sitting up and starting to take notice.

However, there is not just “E” in “ESG” — the Social and Governance factors addressed by the crypto industry are equally newsworthy. Cryptocurrency’s potential in addressing the S and the G factors of global society, while not currently as noisy as the environmental concerns, shows a promise of significant change.

Last week SEBA bank released a report on cryptocurrencies’ compatibility with ESG investment, bringing the scope of the new technology extensively into focus.

Environmental factors pose concerns for widespread usage

The environmental impact of cryptocurrencies is the most talked about of late. With the ethereum merge reportedly wiping almost 0.2% of global energy consumption off the map, the effect of the highly scaled Proof of Work (PoW) consensus mechanism used in bitcoin, among others, has been brought into focus.

As we move closer toward the COP26 emissions goals for 2030, the effects of global warming are ever-present (hello, hurricane Fiona to name the most recent). Environmental concerns are of the utmost priority for many individuals and institutions. Europe has been one of the most vocal in its quest to become carbon neutral, which may explain its publication of a damning report comparing bitcoin’s energy usage to that of midsized countries and hinting at a future ban on PoW.

Despite some within the crypto space being skeptical of such a ban, the environmental impact of cryptocurrencies is undeniable.

SEBA Bank’s report cited an increase in bitcoin’s energy usage from 6.6 terawatt-hours in 2017 to 138 terawatt-hours in early 2022, equal to that of Norway. The total carbon footprint is estimated at 114 million tonnes of carbon dioxide per year.

Without going too much into the ins and outs of why the energy consumption is so high, which you can find here, for the PoW mechanism (and therefore bitcoin) to work, large amounts of energy are essential.

However, SEBA’s report noted that around 57% of the energy consumption has shifted to renewable energy sources.

“You have two ways to look at the issue,” said Yves Longchamp, Head of Research at SEBA bank. “First is where the energy comes from. And the second one is, what is this energy used for? Actually, the energy is not just wasted. It’s used to provide security to the system.”

“Bitcoin is by far the most secure crypto in the world, it has never been hacked, and the cost of hacking is proportional in a way to the energy used. The more energy the blockchain expends, the more costly it is to attack.”

“That’s the USP of bitcoin. It’s something outside the financial system which is peer-to-peer, censorship-resistant and almost unattackable.”

An issue the cryptocurrency industry seems to be aware of

Despite this, the crypto community is aware of the mechanism’s environmental problem, and the SEBA Bank publication reports that, as a result, the Crypto Climate Accord (CCA) has been founded.

According to SEBA, the CCA, a private sector-led initiative, has pledged to transition all blockchains to renewable energy by 2030 and reach net-zero greenhouse gas emissions by 2040.

To reach this goal, the initiative has two objectives:

- “Achieve net-zero emissions from electricity consumption for CCA Signatories by 2030

- Develop standards, tools, and technologies with CCA Supporters to accelerate the adoption of and verify progress toward 100% renewably-powered blockchains by the 2025 UNFCCC COP30 conference.”

This, along with the increase in PoS-based blockchains (SEBA bank reported that only two of the top 20 blockchains are now PoW), could show an increased awareness of large-scale cryptocurrency adoption’s environmental problems could pose and a willingness to address them.

Potential for greater global financial inclusion

Perhaps a factor not so widely reported is the potential for social inclusion cryptocurrencies can pose.

According to the 2021 Chainalysis report cited in SEBA’s publication, emerging economies are the most significant adopters of cryptocurrencies. “More than 80% of the top 15 users of cryptocurrency are from developing countries,” stated the SEBA report. “This suggests that cryptocurrencies offer services these people cannot access otherwise.”

“Once you have more tangible use cases that really affect people’s lives, people see the clear benefit of businesses organized around crypto,” said Mike Castiglione, Director of Regulatory Affairs, Digital Assets at Eventus.

“You will tend to see greater adoption. There have been studies about crypto adoption globally, and the populations that tend to be more favorable toward it are often populations that don’t have trusted financial intermediaries and suffer under high inflation over many years.”

Argentina and Venezuala are such populations. Plagued by soaring inflation long before the current global economic downturn and high mistrust in local financial institutions, the two nations are ranked 10th and 7th for international crypto adoption.

SEBA also noted that for entities that regularly send and receive cross-border payments, crypto offers a relatively “convenient” alternative. Usually faced with settlement times of multiple days in the traditional cross-border payment system, users of cryptocurrencies can expect a significant reduction. Bitcoin and ethereum transfer settlement can range from 12 seconds to 60 minutes.

However, the high volatility of cryptocurrencies can be a deterrent in this use case, opening out the need for stablecoins. The adoption of USDC, for example, has grown significantly in the past two years at a record rate. Experts are responding to this growth, offering financial products to assist in financial inclusion and access to wealth creation tools that previously would have been unheard of in both the crypto and traditional financial sector.

Illicit crypto-related activities are also reported to have reduced to lower than the broader economy (after rising significantly in 2021).

Governance is a leading interest within the crypto community

Web3 and crypto technology has long been a melting pot for governance experimentation.

To create a more democratized financial system, Satoshi Nakamoto, the alleged founder (or founding group) of bitcoin, has been upheld by the crypto community for the focus on decentralization that bitcoin posed.

With decentralization as the initial prime objective, governance systems have been put under the microscope. The crypto world has continued to test mechanisms such as quadratic voting, which could have real-world applications.

RELATED: Soulbound Tokens: A new frontier for decentralization

In the SEBA report, the focus on governance in Web3 is explored. The mechanisms of blockchain protocol governance are explained, breaking down the involved entities, which are different according to the blockchain.

The rise of DAOs, dApps, and tools such as smart contracts have broadened the scope of adopting these governance mechanisms. Many focus on specific causes and the potential distribution of much more than money.

Related:

- Digital asset potential goes beyond speculative investment at IFGS 2022

- NFTs in Ukraine: The platforms, communities, and artists pushing the movement forward

Despite a willingness to explore a more democratic and inclusive governance structure, the crypto community is still rocked by a gender divide. The SEBA report cited findings from Gemini, showing women only represent 26% of crypto investors. This mirrors a general trend in the financial and tech sectors, also showing low levels of gender diversity.

In response to this, various DAOs have been created, pushing a gender equality agenda within the crypto community, again showing an awareness of the issue within the crypto communities.

ESG aligned by design?

Despite the recent media noise, crypto is not so misaligned with ESG. However, SEBA Bank did note that it would be difficult to determine the extent of its alignment within one publication. “In our view, many of them (cryptocurrencies) are, and the general trend is towards more ESG-friendly protocols,” the bank stated.

Through their governance structures, cryptocurrencies and the associated blockchains, DAOs, dApps, and additional mechanisms that form the crypto ecosystem may have public opinion etched into their DNA.

The focus on decentralization and democracy creates significant potential for alignment with the causes most important to the general global public. In turn, this could mean a natural alignment with the three components of ESG.

The post How crypto measures up to the ESG agenda appeared first on News.