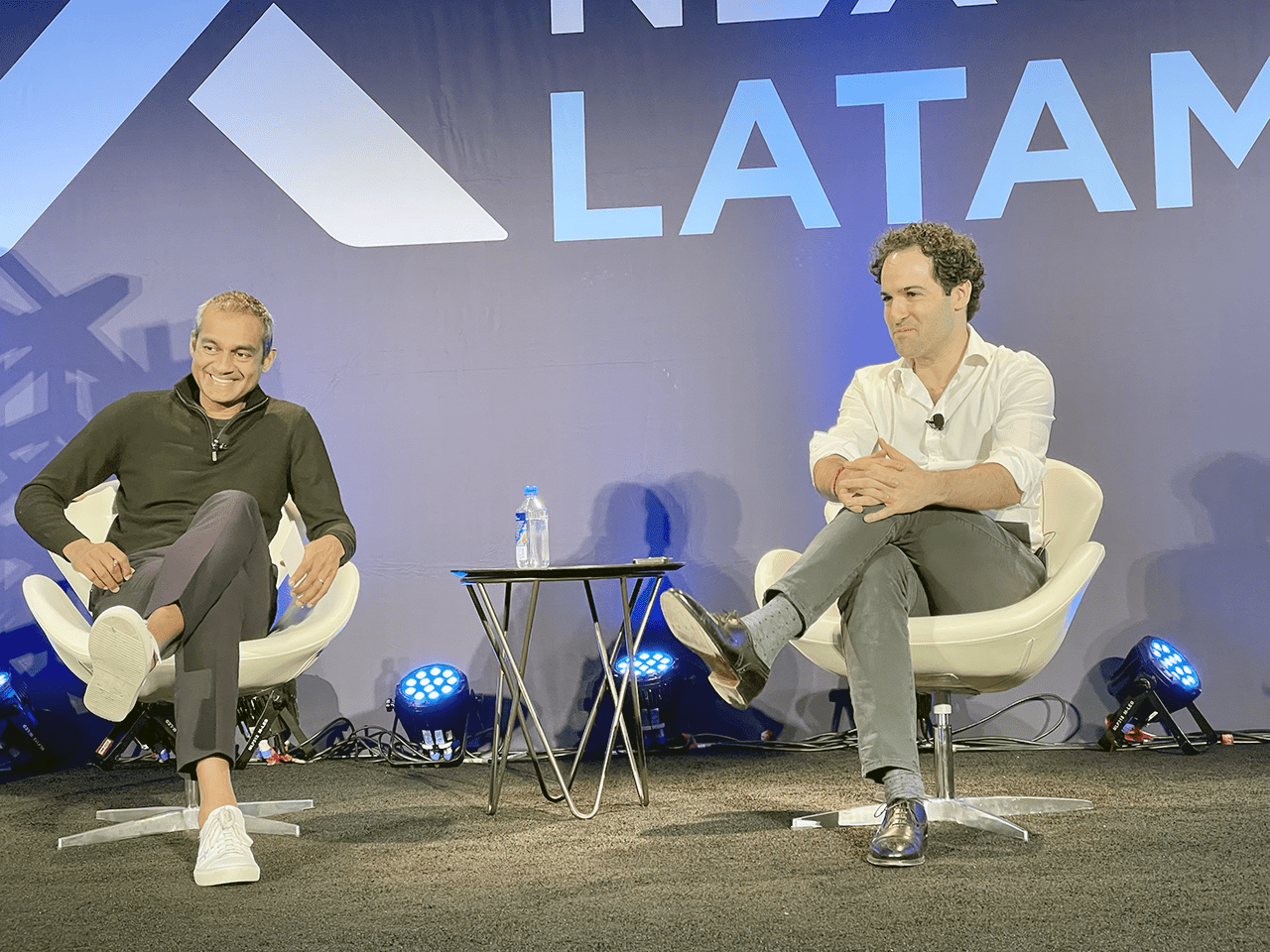

Greeting a crowd of tired conference-goers after a night of parties in Miami, Arjuna Costa, Managing Partner at Flourish Ventures, introduced the early riser crowd to anthropologist turned financial inclusion entrepreneur CEO David Poritz.

Poritz founded Covalto, formally known as Credijusto, a Mexican SME-focused digital banking platform. How did the Mexican SME lender go from startup to licensed neo-bank looking at a NASDAQ-listed SPAC at a valuation of $547 million?

“We’ve had some bumps in the road as any entrepreneur has, and we became a little fragmented in our approach,” Poritz said. “However, we’ve done a good job laser-focusing on profitable and unit economics products. That’s the holy grail. People talk about ecosystems and multi-product strategies, but it’s simple if you can crack that.”

Credit is critical

Costa laid out the estimates on the size of the Mexican SMB market. He said there might be as many as 5 million small businesses in Mexico, with one of the lowest credit-to-GDP ratios. He said the little guys are not getting the funding they need to grow. Estimates say there is a $160 billion gap in financing for SMBs in Mexico. So how did a man with no background in financials decide to step in and change things?

Poritz said Mexico, like Brazil, has a highly concentrated banking sector. Five to seven banks hold all of the wealth and focus on the corporate enterprise and consumer, but no one was doing business with SMBs when he founded Covalto. His answer was not a familiar rant about “tech magic,” as that solution that changed everything. It was, after all, underwriting.

“We realized that credit performance, unfortunately, is the challenge and often results in the demise of fintechs,” he said. “No matter how good the technology is, no matter how innovative you know the acquisition is in terms of customers and how efficient it is. All roads lead back to credit.”

He said the change came in Mexico when the government opened tax data.

“Historically, it has been extremely difficult to develop service models to acquire and service credit risk for SMEs,” Poritz said. “One of the most important changes in Latam in the past decade was the introduction of E invoice digital innovation in the tax code. Mexico was the second country in LatAm to do that, and it has created a real leg up and motivation for banks to leverage data and use it as a tool.”

Ironically in an individual profit sense, when regulators started collecting taxes on a large scale, incorporating digital sources at a broad scale, Poritz said there was suddenly historical data on business for the first time. They were just trying to get tax revenue, but they created a data ecosystem no one served until Covalto stepped in.

“Since 2012, The Mexican government has increased tax collections by 50-60%, so you are seeing dramatic transformational changes in how you can access a historical market,” Poritz said.

They weren’t focused on “microfinance,” he said, or cash-only business, but the low, middle market of small business with more formal accounting. After finalizing underwriting, they built out a suite of products their clients needed in an ecosystem that saw returns.

“Showing you can manage credit risk is critical,” Poritz said. “Are your clients interested in having more than one product you offer? If you can do that, it completely changes the value of that relationship.”

Credit performance is a badge of honor Covalto wears, Poritz said, a reality that did not happen on accident or through luck but because of focus.

Fintech comes into play after underwriting

Poritz said Covalto is the only fintech in Mexico to own a banking license, and the journey to regulatory approval in June 2021 was brutal.

“We were not prepared to buy a bank when we did. It was the biggest risk but the most important decision we made in our development,” Poritz said. “Many folks in this audience are experiencing the realities of dealing with lenders and shaky capital markets. It is night and day from this time last year. The ability to control your balance sheet and funding completely changes economics and risk profile.”

He said it had been a huge learning curve but almost a necessity and no longer a nice to have. If you want to rely on credit facilities for funding, Poritz said it’s fickle, really come and go, and challenging.

How they do it differently

Costa asked how Covalto is the only major player in the SMB lending space in Mexico. Poritz replied with what came after strong underwriting: the tech and data.

He described the future and reality of lending, where underwriting is based on data acquired on the spot from customers. For example, Covalto is the operations partner of Uber Eats, which serves 25-30,000 restaurants in the U.S.

“We get direct data from the REITs on the client performance, we pul that together with other underwriting and information like tax data, and it becomes very powerful,” Poritz said. “The future of where this product evolves is where there are data inputs to acquire customers and underwrite them with ERPs and POS systems that serve as an acquisition channel.”

An audience member asked for advice from a young entrepreneur; how did Poritz and team land that deal with Uber Eats? He said it took time and credibility, chipping away.

“Some of the recent stories about building something with magic alone are hard to come by. It’s really blood, sweat, and tears and being thoughtful,” Poritz said. “I think success is a business model. If you show up daily, continue to be successful, and stick around, you’ll find opportunities.”