Making processes more accessible, faster, and more efficient: It’s something any business wants to take advantage of regardless of the times.

When a global event such as a pandemic shifts how things are done, however, sometimes those efficiencies become necessary for stability and growth.

Dealing with paper in the back of the house, so familiar in many an institution, became a considerable obstacle, recounts Debbie Smart, senior product marketer at Q2 Holdings.

“Larger corporations were kind of in the same boat as banks: they had manual processes that they dealt with, and I think there was an emphasis on trying to improve those processes and create more automation, but it was tolerable how it was until the pandemic hit,” said Smart is a principal author of Q2’s annual commercial banking report along with Gita Thollesson, manager of strategic advisory services for the corporation.

“(It) also created a switch to more digital payments because issuing checks was hard, especially when they had to be cosigned. People were meeting in the park to get the other signature.”

Pair of key fintech takeaways

Two key takeaways in digital back-end transformation and payments innovation from the 2023 State of Commercial Banking Market Analysis Report from Q2 and subsidiary PrecisionLender, released Jan. 31, should further encourage fintechs and small businesses about future opportunities for growth when it comes to service from financial institutions.

It highlights the importance for financial institutions to further partner with fintechs to better service small businesses.

Q2 provides digital banking and lending solutions for banks, credit unions, alt-fi, and fintech companies, enabling them to offer comprehensive data-driven digital experiences to their end users.

Further fine-tuning the digital experience for customers, who have come to expect processes to work much like other processes in their lives, is imperative for commercial bankers who seek to increase revenue opportunities, says Smart.

Like many sectors looking to bolster business in the wake of the economic shutdowns due to the COVID-19 pandemic, banks and credit unions are increasingly partnering with fintechs to improve the digital experience, particularly when it comes to back-end processes.

“What happened is the pandemic took a glaring light and shined it real bright, as though to say, ‘If you’re not in the office, if you’re not in the building, this stuff is much harder to do when it’s manual,’ and then the same thing for customers,” said Smart, who is heavily focused at Q2 on the financial institution’s space.

A ‘mindset shift’ due to new owners’ experiences

It’s a “generational transformation” we’re seeing regarding this process. For small businesses, it’s not necessarily being spurred by the repercussions of the COVID pandemic, but by the technological changes that shape people’s day-to-day life, Smart says.

“The boomers that own the businesses are starting to retire, and the millennials are moving in, and they have different experiences as a consumer,” said Smart. “They’re used to the way Amazon works and Netflix works. They’re used to having predictive things help tell them what they need to do, so there’s a mindset shift because of their experiences as consumers that they’re now bringing to their businesses.”

As Smart co-wrote in the report, “what once was a conversation about self-service and the online banking platform has morphed into a bigger conversation about the digital ecosystem and how it can benefit the financial institution and its business clients.”

By examining processes and identifying inefficiencies that digitization and automation can address, banks can better provide a robust digital experience for customers “while decreasing the time to revenue for the financial institution,” she writes.

Streamlined processes have created a demand

“Say a small business needs a $25,000 loan or a $50,000 loan; they can reach out to SoFi for Amex and have a loan approved in as quick as 48 hours,” Smart said in an interview.

“It depends on the credit rating and the amount they’re asking for and all that, but there’s a whole streamlined process to make that really fast, where those same small businesses going into a bank branch today and filling out an application for a small business loan, it can take weeks sometimes.

“The banks are getting better, and they’re doing better at closing those within a week or two, depending on the bank, but there’s still a significant lag compared to what they’re able to get from the alternative sources for financing.

“So that’s created a lot of the demand: people’s experiences with those other entities. They want to have those experiences with their financial institutions as well.”

Related links

- Pandemic paradigm shift forces digital innovation

- FedNow set to roll out payments highway

- Fed set out FedNow Service pricing approach

- Smart contract development in the booming DeFi sector

The trust factor is ‘huge.’

A pivotal point in the relationship between banks and their customers is the trust factor: both consumers and businesses have faith — there’s ‘still a huge trust with customers,’ says Smart — in their financial institutions.

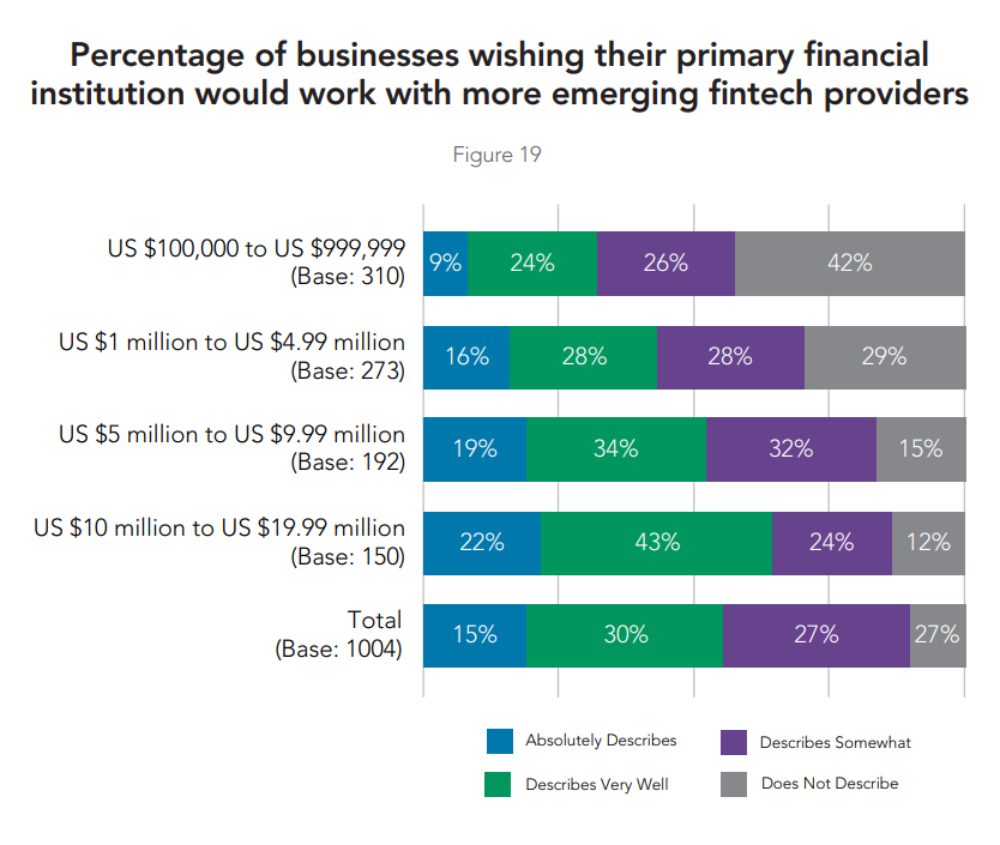

“One of the areas we went into in the report was this idea of fintech integration into the bank’s experiences,” she said. “When we go out and poll small business customers, they really want their bank to be or their financial institution to be the place to bring that all together. They trust the banks. They know that we have access to their data anyway. They know that we can help vet the fintechs and help vet who is good partners.

“The small business customers want those types of services from their banks, and then the banks rely on people like us to help bring that together more cohesively.”

Cost efficiency central to payments shift to digital

Payment innovations are also helping level the playing field, another key takeaway from the Q2 report. The pandemic work-from-home environment and further growth of check fraud have seen more digital adoption by small businesses when issuing payments.

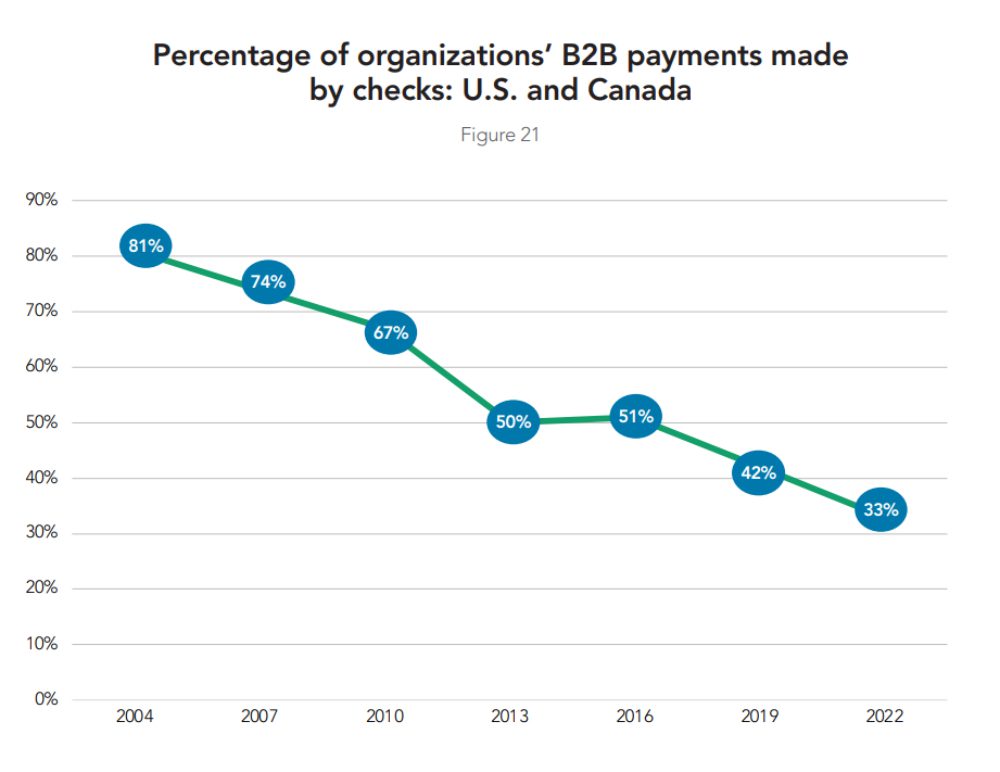

Still, a third of B2B payments in the U.S. and Canada are made by paper check, down from 42 percent in 2019, and a trend has been pointing down steadily, if not sharply, since 2004, when that figure was 81 percent.

“Even though we’ve seen that figure come down, it’s huge,” Smart said.

Beyond making payments faster, the benefit of moving them to a digital system is cost efficiency. Invoice/remittance data can travel with the payment from start to finish. New instant payment rails set to be introduced in the US, such as the Federal Reserve bank’s FedNow service, are expected to help transform payment tasks.

“The larger companies that are suppliers to small businesses are looking for ways to streamline how they’re paying. They would rather not get checks, but if they get an ACH, they don’t want the information in an email,” Smart said. “That’s why I think the rich messaging capabilities that the new instant payment rails offer are an opportunity for us to solve that pain point finally.

“I’ve been seeing this pain point with businesses for decades, for easily 20-30 years. I remember in the 1990s having situations with businesses trying to incentivize their smaller businesses or trading partners to pay electronically and figure out how to get the remittance information there.”