Christine Lagarde, President of the ECB, stated, “Banknotes are part of our economy, identity, and culture.”

However, as the world moves further toward cashless systems and the ECB explores, with mounting fervor, the potential of CBDCs, will cash (and the associated payments privacy) continue to hold the same importance?

SPACE report shows a shift to cashless

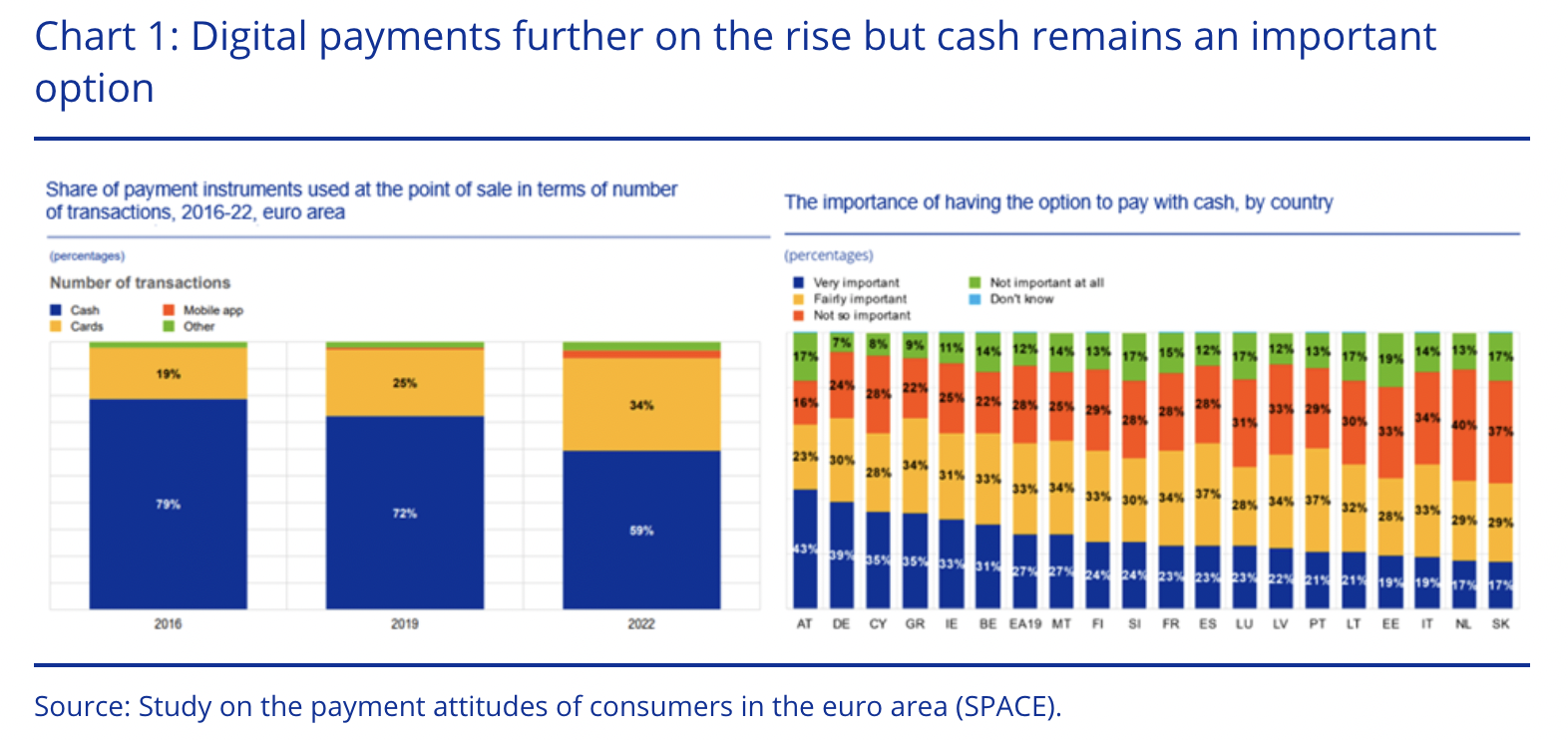

In the second of the ECB’s Study on the payment attitudes of consumers in the euro area (SPACE), completed in 2022, it was found that while cashless payments continue to grow in popularity, cash is still substantial in the eurozone.

Cash is the most frequently used payment method at the point of sale (POS), accounting for 59% of transactions, while cards account for 34%. However, the gap between the two is closing each year, and 55% of consumers prefer cashless payments. The value of card payments also surpassed cash for the first time, rising to 46% of transactions.

“Monitoring these trends closely going forward is important for us, given our responsibility for issuing public money (currently in the form of cash, and possibly in the future in the form of a digital euro alongside cash) and promoting the smooth functioning of payment systems,” stated Fabio Panetta, ECB Executive Board Member, in the opening of the report.

“This will help us ensure that means of payment remain accessible to all euro area citizens, regardless of their age, income or place of residence, guaranteeing consumers’ freedom to choose how they pay, even in digital transformation.”

Cash in a time of CBDCs

Although consumers preferred cashless payment, the majority still considered the existence of cash important, favoring its anonymity and the perception it maintains awareness of expenses.

The ECB has shown a commitment to preserving cash as a form of payment and launched the Eurosystem Cash 2030 strategy in 2020. Within the strategy, it was ensured that the issuance of cash would be protected, alongside access to cash services and the innovation of bank notes.

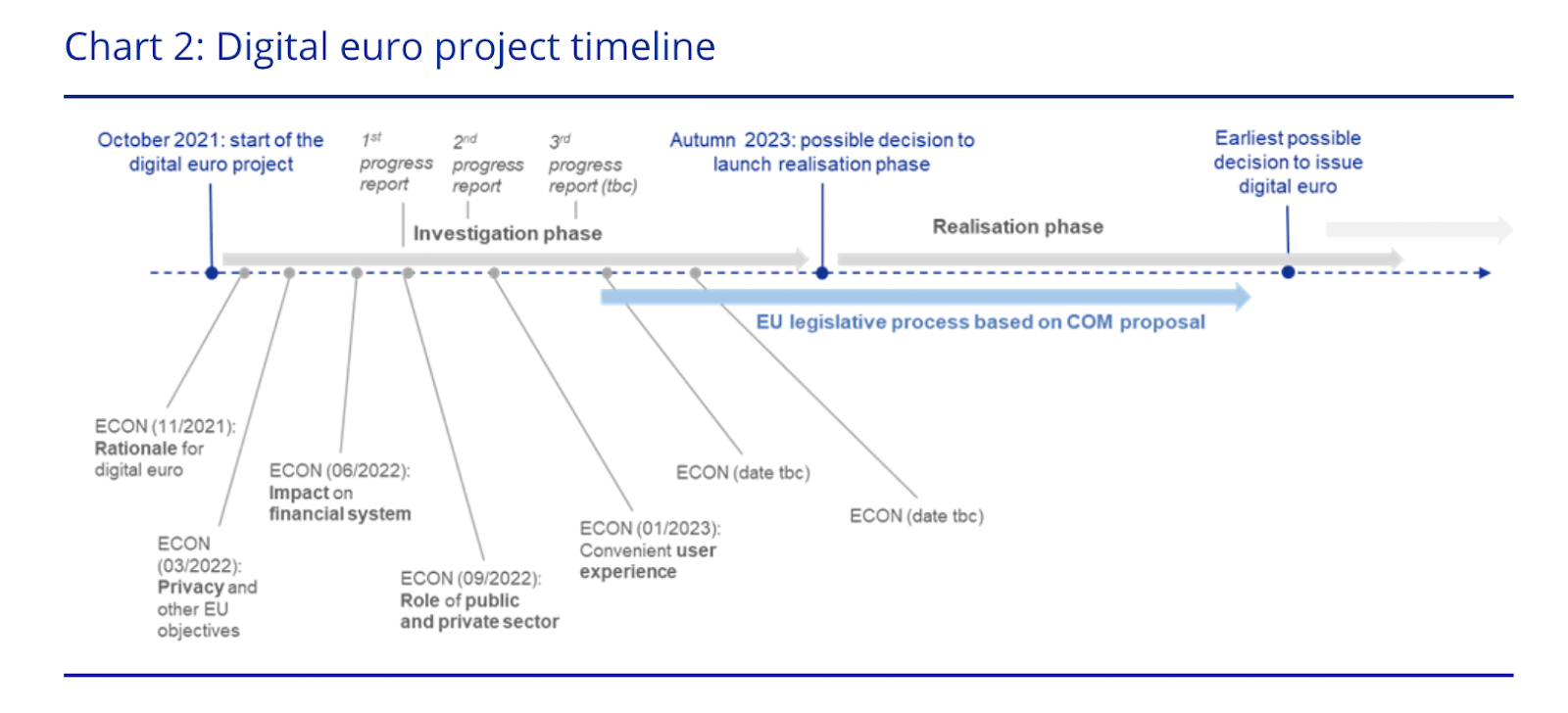

However, the organization also has set its sights on developing a CBDC and plans to outline a legislative framework by “early 2023”.

Privacy is a sticking point for many in developing a digital euro for use alongside cash. In the ECB’s preparatory public consultation, 43% of respondents considered transaction confidentiality the most important aspect of the design of the digital euro. Many believe their privacy will be more controlled if cash were to disappear.

As a response, the European Data Protection Board (EDPB) has called on the ECB to safeguard the privacy of the digital euro to similar levels as cash. Along with a recommendation to uphold this safeguard with the planned legislative framework, they suggested the need for privacy thresholds and offline electronic wallets as a priority feature of the proposed currency.

Showing its support of the EDPB, The Commission Nationale de l’Informatique et des Libertés (CNIL) has stated, “A digital euro that does not respect the principles of necessity and proportionality of data collection and processing would not comply with either the GDPR or Articles 7 and 8 of the European Charter of Fundamental Rights.”

It seems these recommendations are front of mind for the ECB, and the organization released a statement on January 23, 2023, stating their objectives for the digital euro in the year ahead.

A design that included offline payments seems to be in the mix and is stated to have similar privacy levels to cash. The organization plans to continue testing and development, exploring ways to make the digital euro as convenient as possible. The realization phase could commence as early as the Autumn of this year.

Within this outlook, the ECB reestablished its commitment to upholding the existence of cash.

“The digital euro would not replace other electronic payment methods or cash. Rather, it would complement them,” said Panetta. “By doing so, it would safeguard our monetary sovereignty while strengthening Europe’s strategic autonomy.”