No doubt, when Binance CEO CZ took to Twitter in the early moments of the FTX failure last year, he felt that the crypto world was now his for the taking. Binance’s largest competitor was on the ropes, and the internet looked to be hanging on CZ’s every word. But alas, how the mighty have fallen.

This year, Binance has been hit from all sides. Regulators have cracked down on the exchange, causing activity to plummet, and executives seem to be dropping like flies. The company’s handling of mass layoffs likely didn’t help their trajectory. Other exchanges are gaining on Binance and, while its lead is significant, pressure is mounting, its market dominance is dwindling.

One insider alleged that Binance has conducted “fire drills” for quick asset withdrawal in the event of a meltdown. Which doesn’t instill confidence. If Binance does collapse, the short-term may be catastrophic, driving the crypto market down.

Eventually, other exchanges are likely to fill its void, but it could spell disaster for trust in crypto. But if the SEC’s allegations of fraud are true, one could say Binance, like FTX, is poisoning the industry.

Yes, Binance was a major driver of innovation and growth in the industry, but that’s no excuse to remain blind to misdealings. Perhaps crypto is better off without.

FEATURED

The Worlds Biggest Crypto Firm Is Melting Down

‘Every battle is a do-or-die situation,’ Binance co-founder Yi He writes.

FROM FINTECH NEXUS

FIs Turn to Blockchain Despite Crypto’s Regulatory Uncertainty

US regulators plan to continue their enforcement of crypto, leaving the industry without much needed clarity. However, FIs carry on adoption.

Fintechs make inroads in Mexico’s digital economy

Fintechs in Mexico take on the challenge of competing with banks, in a country that lags most Latin American peers in financial inclusion.

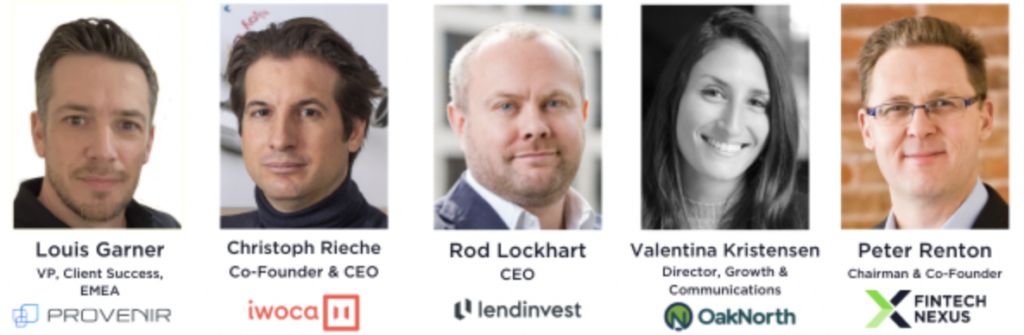

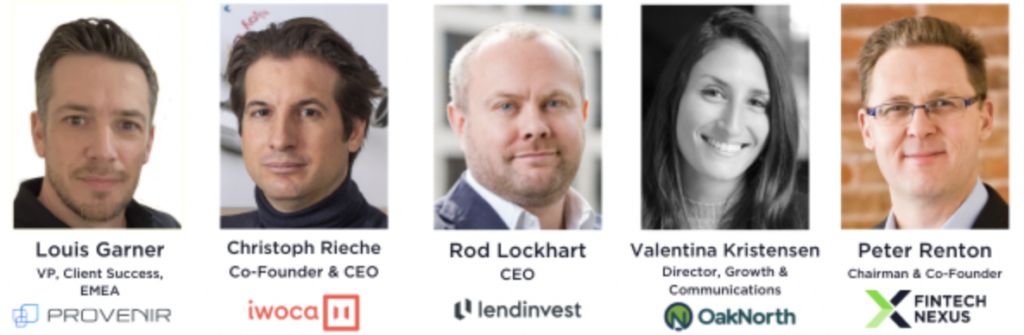

WEBINAR

Trends in digital lending for 2024: AI, automation, embedded finance and more

Oct 10, 9am EDT

As we begin to look to 2024, we can expect technology to continue to have a profound impact on consumer lending.

Register Now

ALSO MAKING NEWS

- Global: How banks can cross the ‘uncanny valley’ as AI becomes more humanBanks need to — and can — take steps to manage the phenomenon, first defined by a Japanese academic in the 1970s, where artificial intelligence looks, feels or sounds human and gives customers a creepy feeling, experts say.

- LatAm: Argentina Central Bank Move Slammed as ‘Attack’ by Mercado PagoA technical measure by Argentina’s central bank Monday provoked a rare public rebuke by the fintech arm of MercadoLibre Inc., another sign of the government’s damaged relations with private business.

- USA: IRS Proposed Rule on Digital Asset Broker Reporting Could Kill Crypto in AmericaThe proposal creates unworkable requirements for decentralized finance in the U.S. and serves as an important cautionary tale.

- USA: Wading into new waters: Microsoft launches Xbox-centric MastercardMicrosoft launched an Xbox Mastercard last week exclusively for US users enrolled in the Xbox Insider program – members of which can preview and provide feedback on new Xbox features and system updates.

- USA: Why Delinquencies Could Spoil The Soft Landing For BanksAs more consumers fall behind on loan and credit card payments, the time is right for banks to rethink and update their collections strategies for the digital age.

- Global: MoneyGram unveils non-custodial wallet to bridge the worlds of crypto and fiat currency with USDCThe product is the latest effort to use blockchain technology to address the costly remittance sector.