Fintech unicorn Clara continued to expand its offering in Brazil by launching a high-yield payment account in the country, unveiling another chapter of its ambitious growth strategy in Latin America’s largest market.

The company, which relocated its headquarters from Mexico to Brazil in August, aims to achieve 6 billion reais in transactions by the end of 2024, equivalent to nearly $1.25 billion. Clara aims to expand its market share in the local business-to-business payments market, and envisions Brazil as its largest market as of next year.

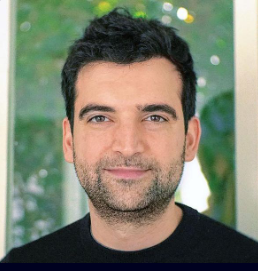

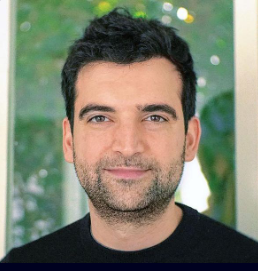

The company began operating in the country back in 2021 but is now aggressively ramping up its operations after securing a payments institution license this year. “Clara Conta”, as the new product was named, would be instrumental in boosting customer acquisition. “This is just the beginning of a series of launches: soon we should offer PIX and other features aimed at bringing even more convenience to the daily lives of our users,” said Francisco Simon, country manager of Clara in Brazil, in a statement.

Established in Mexico in 2020, Clara provides corporate cards and management software for businesses across the region. The company seeks to double its customer base in Brazil in 2024. Big-sized institutions like Banco Votorantim and BR Malls are reportedly among its clients. The fintech reports monthly transactions of 100 million reais, equivalent to $20 million.

Clara, regional fintechs drawn to Brazil

Clara’s endeavor in Brazil comes as the market gets increasingly crowded. In the fiercely competitive digital space, several neobanks, including Nubank, Inter, PicPay, and PagBank have amassed millions of customers in recent years, sparking intense competition for customer dominance. Notably, these digital lenders have reported substantial customer bases in the local market, with many turning profitable in recent quarters.

However, their focus has been mostly on individuals.

Soon, Clara aims to expand its services by offering deposits through Brazil’s widely used instant payment system, PIX. Launched by the central bank during the pandemic, PIX has seen significant adoption in the country, with over 150 million Brazilians utilizing it. It has become ubiquitous in the country’s largest urban populations, presenting fintechs and banks with a critical opportunity to acquire customers and cross-sell their own products.

“Our goal is to consolidate Brazil as our main market by 2024,” Gerry Giacomán, CEO of Clara, told Fintech Nexus in a recent interview. “Brazil, in addition to being one of the largest economies in Latin America, represents a great opportunity for our payment solution, as it has a more mature financial and digital ecosystem, with particular solutions such as PIX.”

A fintech license, key to the strategy

The Pix experience since 2020 has not just opened up business possibilities but has also been a major force in popularizing digital finance among the population, bringing many underbanked individuals into the digital realm. Giacomán highlighted to Fintech Nexus that one of the reasons driving Clara’s decision to enhance its offerings in Brazil stems from the population’s strong affinity for digital payment methods.

Clara operates over a billion reais in yearly transactions, or nearly $200 billion. It has over 10,000 customers in Latin America, 2,000 of which are based in Brazil.

The fintech achieved unicorn status in 2021, joining a coveted list of fewer than a dozen Mexican unicorns. Its executive has underscored that the decision to grow in Brazil would not undermine its prospects back home in Mexico, yet it has made it clear that the South American nation is now the major strategy for the firm.

Earlier this year, Clara took in $60 million in a Series-B funding round led by GGV Capital. Before this, the fintech had obtained $90 million in debt from Accial Capital.