Today, Visa announced a new suite of payments capabilities called Visa Commercial Pay. This is a suite of B2B payments tools targeted at corporations.

Part of the product suite is the ability to add corporate virtual cards into employees’ digital wallets such as Apple Pay or Google Pay. This provides more granular control over employee spending as the virtual card can be provisioned for certain limits with specific merchants.

This is not a new idea, B2B payments companies like Ramp and Brex have developed the ability to issue virtual corporate cards like this but now Visa is providing this capability natively.

Their first bank partner for this technology is Regions Bank in the U.S. Visa is also rolling out these enhanced payments capabilities to the Latin American & Caribbean region.

While fintech has created a lot of innovation in the corporate spend space it is easy to forget that these capabilities have not been extended to traditional banks for the most part. Visa is looking to change that.

Featured

> Visa Integrates Virtual Corporate Cards With Digital Wallets

www.pymnts.com

Visa’s suite of B2B payment solutions now enables financial institutions to add virtual corporate cards to the digital wallets of their clients’ employees.

From Fintech Nexus

> The future of payments is choice: Gnosis Pay CEO Marcos Nunes

By Tony Zerucha

While the future of payments is digital, Gnosis Pay co-founder and CEO Marcos Nunes said that leaves plenty of room for consumer choice.

> Fintech: Moody’s downgrades New York Community Bancorp to junk status

By Laurence Smith

NYCB absorbed billions in loans from Signature bank upon its failure, which increased regulatory capital requirements and led to a dividend cut.

Podcast

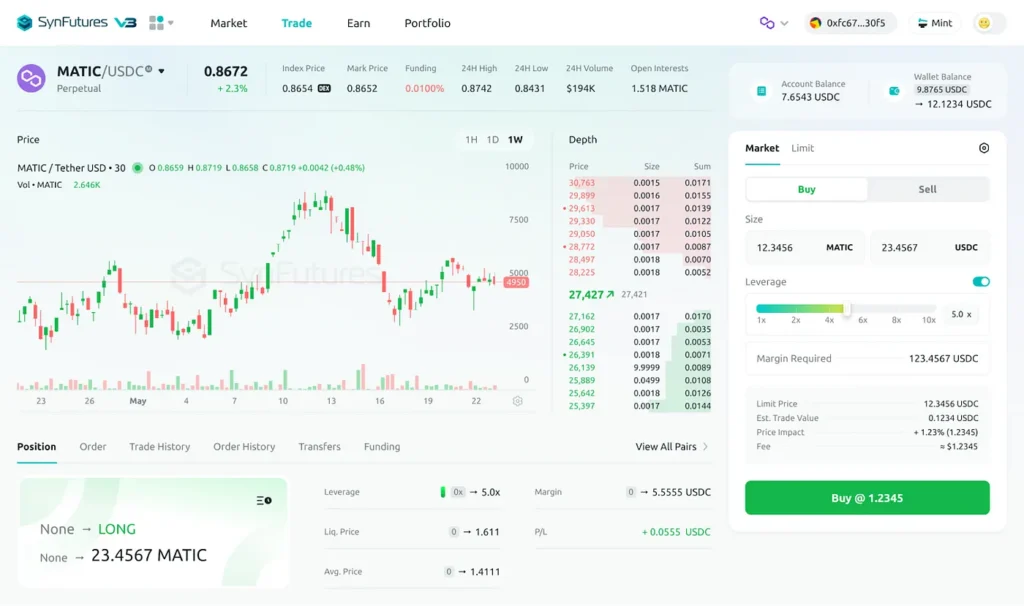

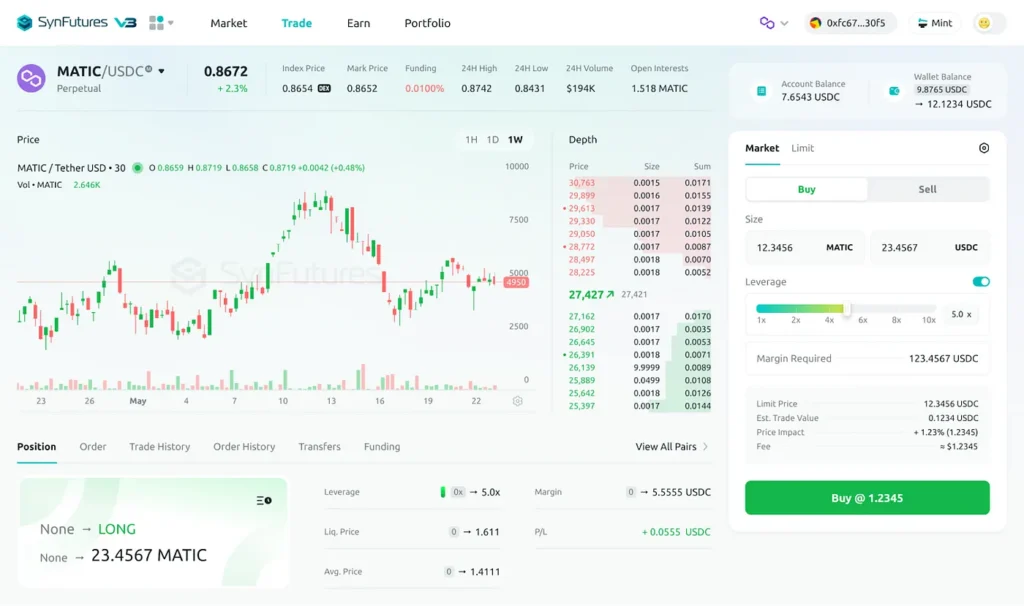

> The evolution of derivates from structured products to decentralized perpetuals, with SynFutures CEO Rachel Lin

Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can…

Listen Now

Also Making News

- USA: Employers Can Now Enroll Workers in Some Emergency Savings Accounts

But many companies are spurning the “clunky” legal requirements for accounts linked to retirement plans. Instead, some have stand-alone rainy day offerings.

- USA: Lenders weigh sports marketing as Rocket, UWM skip Super Bowl

Only a few dozen mortgage firms could likely afford the $7 million ad for this year’s big game, a marketing veteran said.

- USA: Citi moves deeper into e-commerce through digital couponing

The bank recently launched a browser extension that searches for coupons on merchant checkout pages, suggests applicable codes and can activate cash-back offers.

- USA: Open Banking Regulation Is (Almost) Here: Why It Matters

The Consumer Financial Protection Bureau—CFPB for short—recently proposed rules for the U.S. open banking market.

- USA: Older Americans demonstrate more digital financial literacy than younger peers

Digital financial literacy among Americans increases with age, according to research from Capital One.

- UK: Digital Bank Revolut to Offer eSIMs and Global Data Plans to UK Clients

Revolut, a digital bank/neobank with over 35 million customers worldwide and 8+ million in the United Kingdom, is offering eSIMs and global mobile data plans to its UK clients.

- USA: Score is a new dating app for people with good to excellent credit

You must have at least a 675 credit score to use it.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.