We had an update from the Federal Reserve on FedNow this week. There are now 400 banks participating in the instant payments network as either a sender or receiver.

They launched last July with 35 institutions and have been growing steadily since then. The last public statement that I have heard was when FedNow chief, Mark Gould, spoke at the American Fintech Council’s Policy Summit in November when they had 200 banks on the platform.

Some of the country’s largest banks such as Bank of America, Citi, Capital One and PNC have still not joined. But these banks have indicated that they will eventually join.

Most large banks are members of The Clearing House’s RTP network so can process real-time payments via that network. Then, of course, there are also real-time payment offerings from the card networks, Visa Direct and Mastercard Send, that have almost universal coverage and work internationally as well.

FedNow is run by the federal government so it can afford a slow rollout. The Fed is playing the long game and it is inevitable that most payments will move to real-time eventually.

When that happens FedNow will likely be a huge player in payments.

Featured

FedNow draws some banks, as others lag

By Lynne Marek

The crypto exchange is seeking the dismissal of a lawsuit at the center of the agency’s oversight strategy.

From Fintech Nexus

> In 2024, Lenders Need a Better Delinquency Strategy

By Rochelle Gorey

Lenders’ delinquency strategy must be rooted in an “empathy-first” model to support customers in experiencing hardship. Customers in distress need support and resources, not shame.

> Liveness detection is cat and mouse

By Tony Zerucha

The importance of liveness detection was one positive development arising from the COVID-19 pandemic. It’s an essential feature of a biometric-based security strategy, iProov chief product and innovation officer Joe Palmer said.

> DeFi: Tokenization is cool again, from Franklin Templeton, to Fasanara’s Untangled Finance, & SC Ventures Libeara

lex.substack.com

The tokenized funds market witnessed its issuance on public blockchains grow from $100 million to over $800 million in 2023.

Podcast

Andrew B. Morris, Chief Content Officer and Curt Persaud, Co-Founder & CTO of Fintech Islands on Caribbean fintech

Fintech Islands is the biggest fintech event in the Caribbean, it is taking place on January 24-26 in Barbados.

> Listen Now

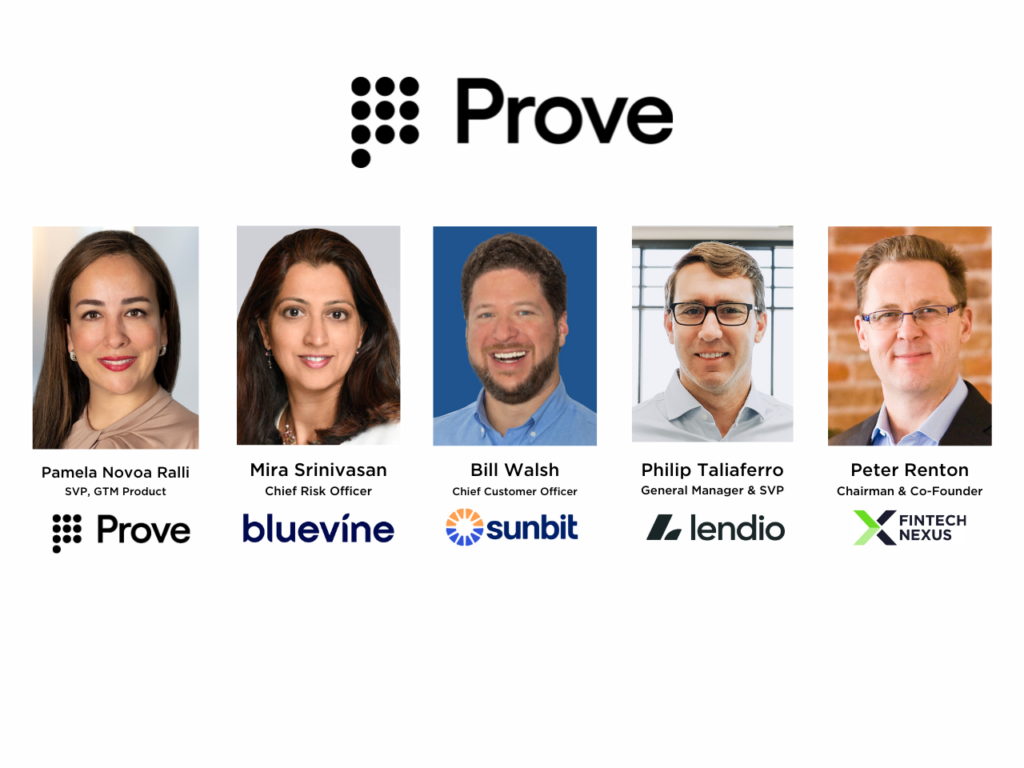

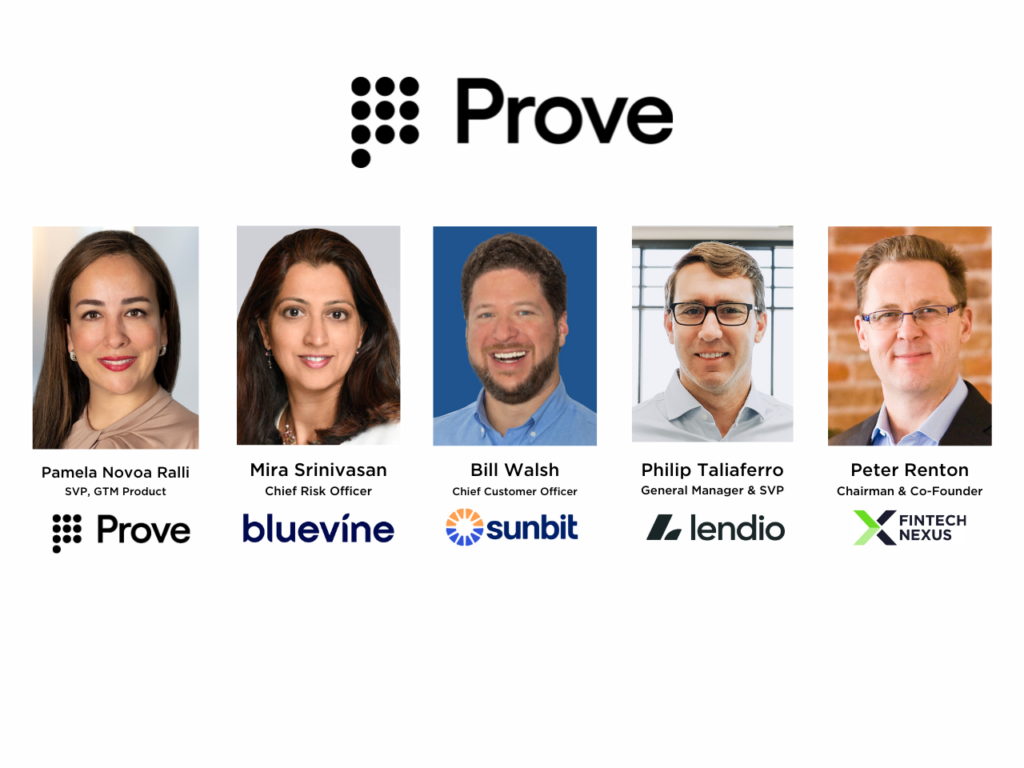

Webinar

Building Trust: Scalable Strategies for Consumer and Business Onboarding

Jan 23, 2pm EST

Identity verification is a key part of financial institutions’ and banks’ customer journeys. However, with ongoing compliance…

Register Now

Also Making News

- Europe: Apple Offers to Open Mobile Payments to Third Parties Amid EU Antitrust Case

The tech giant’s proposal is aimed at allaying competition concerns from European regulators.

- SA: DailyPay Raises $175 Million to Grow On-Demand Pay Platform

On-demand pay company DailyPay has secured $175 million in funding, resulting in a 75% increase in the company’s valuation to $1.75 billion.

- USA: Kashable banks $25.6M to offer employment-based lending

Kashable integrates with a company’s payroll systems to extend affordable credit to that company’s employees.

- Global: X As SuperApp Or Smart Wallet: Musk, Money And Identity

The business model of X is advertising, so your data is worth vastly more than any transaction fees he might be able to collect from you.

- USA: LoanDepot outage drags into second week after ransomware attack

LoanDepot customers say they have been unable to make mortgage payments or access their online accounts following a suspected ransomware attack on the company last week. The mortgage and loan giant said on January 8 that it was working to “restore normal business operations as quickly as possible” following a security incident.

- USA: Why Big Banks (and Some Odd Allies) Oppose a Plan to Protect Banks

Federal regulators want to raise capital requirements for big banks. Their plan is drawing criticism from groups that aren’t normally aligned with the industry.

- Global: AI is bringing ‘Minority Report’ payments and loyalty to life

Companies like NCR Voyix, Salesforce and Sainsbury’s are keen to deploy technology that used to be science fiction — such as scanning a shopper’s eyes to access their accounts, or using AI to streamline checkout.

- USA: SEC Punts Fidelty Spot Ethereum ETF Decision to March

The SEC has stated it needs “sufficient time to consider the proposed rule change and the issues raised therein.”

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.