When we covered the BlackRock announcement last week of their new tokenized treasuries fund I thought it was a big deal.

One week in, this new investment vehicle (ticker symbol BUIDL) is proving to be quite popular. On-chain data shows that $245 million worth of BUIDL shares are now held in seven different wallets. That is the beauty of blockchain data, everything is transparent.

The tokenized fund was deployed on Ethereum last week with an initial investment of $5 million. The fund holds U.S. Treasuries and repurchase agreements with shareholders earning yield in the form of BUIDL shares. The price of BUIDL is pegged at $1, like a typical money market fund.

With BlackRock now involved, 2024 could be a breakout year for the tokenization of real-world assets (RWA). HSBC has launched a tokenized gold product in Hong Kong and there are many other projects around the world coming online.

Tokenization of RWA has had slow adoption since it was first imagined several years ago. But now that some of the biggest financial institutions on the planet are actively involved, there is serious momentum in this sub-niche of blockchain technology.

Featured

> BlackRock’s Tokenized Treasuries Fund BUIDL Sucks Up $245M In First Week

By Samuel Haig

Investors have piled a quarter of a billion dollars into the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) in one week.

From Fintech Nexus

> Unicorn recipe unveiled in Team8 report

By Tony Zerucha

A new report from company builder and venture group Team8 shows it’s a good time for fintechs to pursue unicorn status, provided they do the groundwork.

Podcast

> Julie Szudarek, CEO of Self Financial on building credit

The CEO of Self Financial talks about the importance of building a good credit score, financial literacy and how a credit…

Listen Now

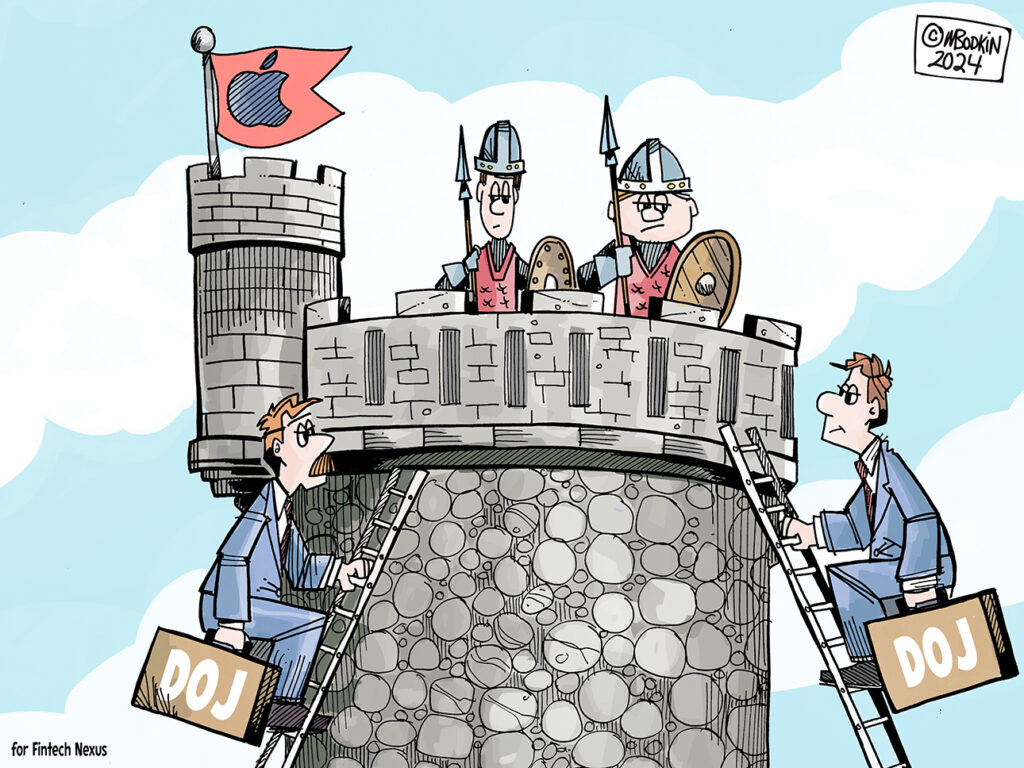

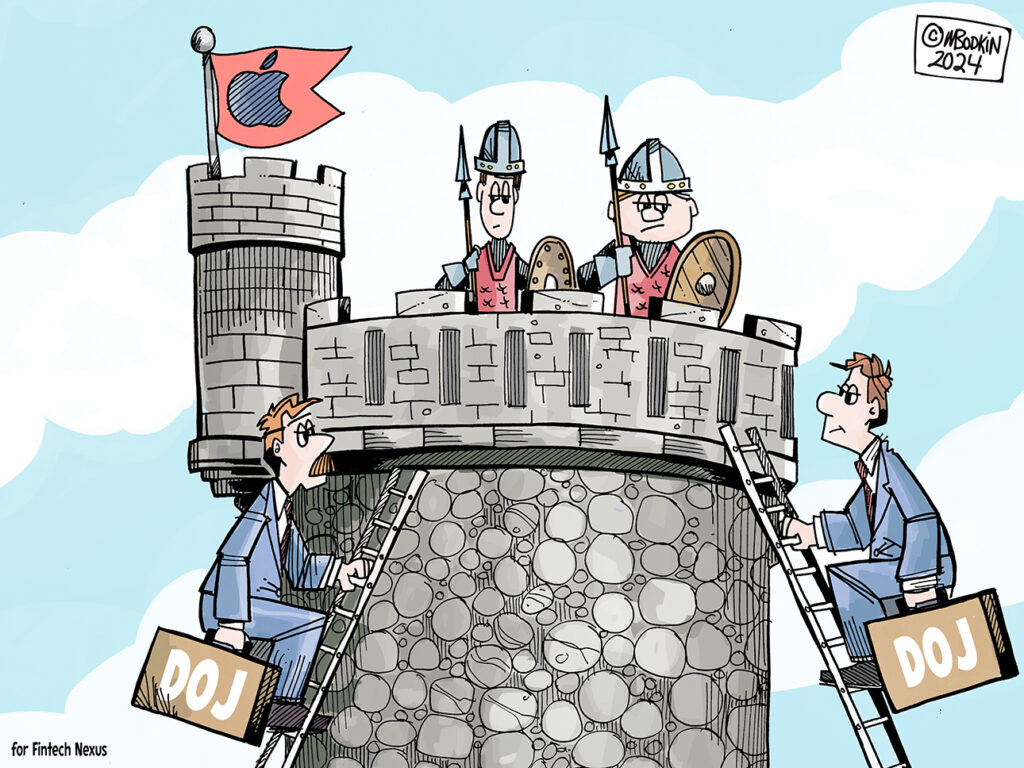

Editorial Cartoon

Also Making News

- USA: LendingTree Secures $175 Million in Financing to ‘Navigate Current Market Environment’

LendingTree has secured up to $175 million in financing from funds managed by Apollo affiliates. The company, which operates online financial services marketplace LendingTree.com, will draw $125 million of the first lien term loan facility upon funding, using it for general corporate purposes that may include the repayment of existing debt.

- USA: How KeyBank’s approach to fintechs set the tone for product development

The bank is launching KeyVAM, a virtual account management offering it designed with fintech Qolo. Both companies said the nature of the relationship was as important as the technology it produced.

- Europe: EU banks worried about ‘unrealistic’ instant payment deadlines

A third of EU banks do not currently offer an instant payments service and the majority have been discouraged by the January 2025 deadline, according to recently published research.

- USA: Amazon One launches new app to scan your palm for checkout

Amazon announced Thursday the launch of its new app for Amazon One, its contactless palm recognition service that allows customers to hover their palm over a device in order to purchase from select places, including over 500 Whole Foods Market stores, Amazon stores, and more than 150 third-party locations.

- USA: Santander hires ex-Marcus chief to lead US digital transformation

Swati Bhatia becomes the second Goldman consumer-banking vet to find a landing spot in just over a week.

- USA: Coinbase must face US securities regulator’s lawsuit, judge says

A federal judge in Manhattan on Wednesday said the U.S. Securities and Exchange Commission’s lawsuit against Coinbase can move forward, but dismissed one claim the regulator made against the largest U.S. cryptocurrency exchange.

- USA: ADP Teams Up with Summer to Support SECURE 2.0 Student Loan Retirement Match

Today, Summer and ADP announced an integration to support student loan benefits offerings. This relationship will make it possible for all of ADP’s retirement plan clients to offer Student Loan Retirement Matching and additional student debt tools through Summer’s platform.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.