The following is an excerpt from today’s Global Newsletter.

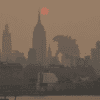

This morning’s featured news is from *cough* sorry, is from Amazon, who partnered with Affirm to offer *cough* wow, sorry again… just a second…

*Ahem, whoooooahhh, COUGH*

There we go. Wow, that smoke is really hitting all of the wrong places this morning.

Right, where was I? Oh yes, Amazon partnered with Affirm to offer BNPL to their North American customers. Any purchase over $50 qualifies for a 0% annual rate BNPL option. This is an FBD (“really” big deal, in fintech-speak).

It did not take us long to expect BNPL options with our digital purchasing activities. For example, regardless of whether or not I have disposable income to cover non-staple purchases, I seek out the BNPL providers to keep my savings in my accounts longer and spread out the purchase pain over several months. Is it partly to improve my chances of avoiding buyer’s guilt? Maybe.

No matter the motivation, it just makes sense for consumers, and vendors will likely tack on the expected fees to the selling price to recoup their side of the cost, much like they have done with Visa/Mastercard et al., for years.

Featured

| Amazon Pay taps Affirm to be its first buy now, pay later player By Mary Ann Azevedo Amazon Pay has tapped Affirm to offer buy now, pay later options to consumers, the companies announced today. |

Sponsored

Calling all builders! Subscribe to The Fintech Blueprint for in-depth analysis of fintechs, DeFi & investing. From the mind of Lex Sokolin, Chief Economist, ConsenSys. |

From Fintech Nexus

Digital payments won: Now what? By Tom Bell Americans overwhelmingly prefer digital payments over cash establishing that embedded finance is the next frontier. |

Fintechs Kapital, Stori tap $115M with eyes on SMEs and underbanked in Mexico By David Feliba Fintechs in Mexico draw funding to cater to underbanked SMEs and individuals. Kapital tapped $65 million, while Stori secured $50 million. |

Podcast

| Fintech One-On-One: Al Crawford of BHG Financial In this episode, we talk with Al Crawford, the CEO, and Co-Founder of BHG, one of the earliest fintech lenders. Listen Now |

Webinar

How to Be Innovative and Compliant in Digital Lending

Today, 2 p.m. EDT

Loan servicing, which makes up 90% of the life of a loan, has yet to see significant personalization.

Register Now

Also making news

- Europe: A flawed argument for central-bank digital currencies Europe’s policymakers are wrong: the economy does not need a digital replacement for cash

- USA: Binance moved billions through two U.S. banks, regulators say The SEC shared new details about how Binance’s accounts at Signature Bank and Silvergate Bank were used to move customer funds quickly through a web of foreign companies.

- USA: Durbin revives credit card swipe-fee bill with added support Merchants are getting another shot at changing the rules around the “swipe fees” they pay to banks when they accept Visa and Mastercard credit cards.

- USA: Binance.US was deeply unprofitable in 2022, documents showThe U.S. arm of Binance, the world’s largest crypto exchange, lost $181 million last year, filings by the Securities and Exchange Commission showed.

- Global: Fraud and AML investigations are taking more time, but financial crime is getting faster Cutting down on fraud and money laundering is a cat-and-mouse game. Money laundering in the U.S. makes up 15% to 35% of all money laundering in the world. Around $800 billion to $2 trillion is laundered globally, and $300 billion of that amount is laundered in the U.S.

- USA: Digital wallets are hot, but the family digital wallet is a $26 billion deposit opportunity A new study finds that banks should offer family digital wallets to help consumers manage Gen Z and Gen Alpha kids’ finances. The bonus benefit: deposit acquisition.

- LatAm: Study: Regulations are needed to advance open finance in Latin America The publication offers an overview of the current state of Open Finance in Latin America and the Caribbean and the potential benefits.

- LatAm: Nubank’s ‘little boxes’ onboard 1 million users in Mexico Nubank reached the mark of 1 million active users in Mexico just one month after launching its savings accounts product in the country. The bank will also launch a Mexican debit card for customers to withdraw cash from ATMs.