John Lynch and his fraud identification team at Amount had automated many processes for its banking partners, but were still looking for a way to enhance their services and reduce the time it required to verify customer details.

Authenticating individuals’ addresses and incomes required time-intensive human investigation, which could take hours instead of seconds. Manually reviewing documents took up a significant part of the staff’s work time.

“We urgently needed to find a faster, scalable process that we could use alongside our human expertise to build greater efficiency in our process, and standardize our risk-screening and decision-making,” said Lynch, the fintech’s senior director of fraud and verification services.

Much the same dilemma faced the staff at Plaid.

For the data network that powers thousands of fintech companies like Venmo and SoFi, bolstering fraud detection and risk mitigation efforts is critical to boosting its services. Identifying fraud quickly and accurately is essential in reducing risk and fostering growth.

“The main pain point that we’re trying to solve is ensuring the document data we give our customers has very high fidelity,” said Plaid project manager Rohan Sriram. “Ultimately, they want to trust the information that they have and use it to make the right decision.”

Quick turnaround time

Ultimately, both firms turned to Inscribe. The quick turnaround time analyzing a document helped Plaid’s customers “move applications a lot faster,” said Sriram. The team at Amount found that Inscribe helped them “identify legitimate applications faster and instantly identify applications that need further attention” to free up time for other priorities, said Lynch.

The fight against document fraud is a constant for financial services companies.

While statistics vary yearly, there was a 79 percent increase in document fraud in 2022.

Such a number doesn’t come as a surprise to Inscribe fraud analyst Daragh McMeel. A rise in fraud rates often occurs when the economy travels an uncertain and challenging path that much of the world is navigating now.

And with fraud on the rise, it’s essential to stay as far ahead of fraudsters as possible. Since 2020, much attention has been paid to third-party and synthetic fraud, which sees people either assume someone else’s identity or create a false one. Synthetic fraud was responsible for $20 billion in losses by U.S. financial institutions in 2020.

Rise in first-party fraud spurs action

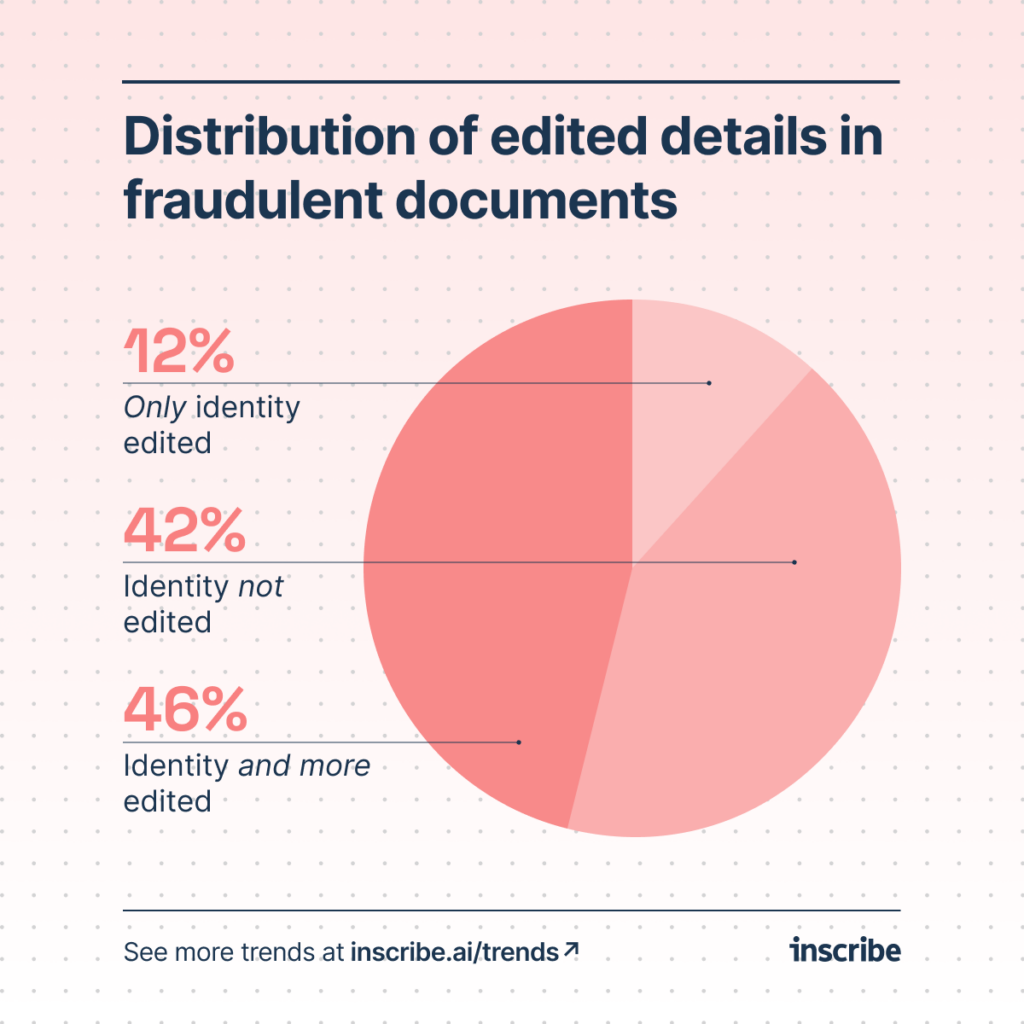

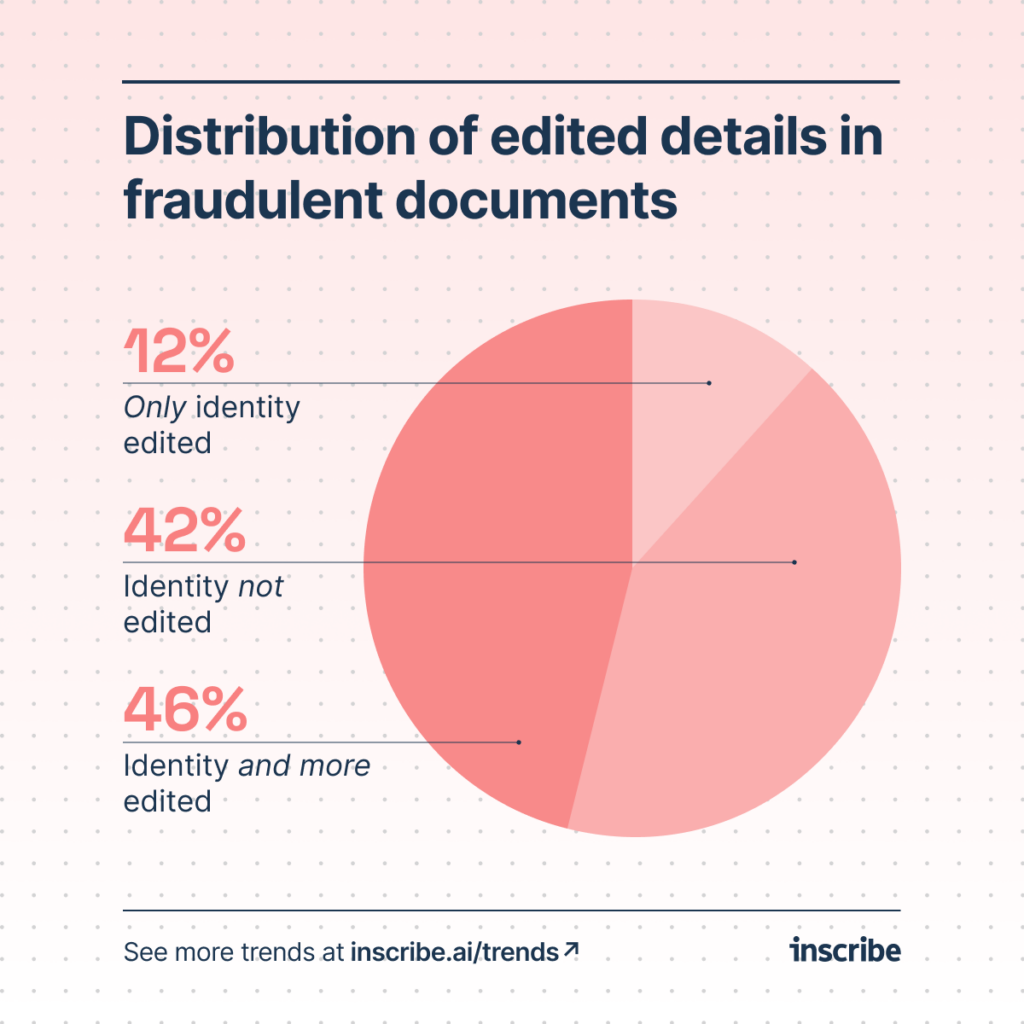

However, suspicions about the effects of first-party fraud — that which sees a legitimate customer falsify their financial details — rose among financial institutions. Their fears were justified. According to Inscribe’s 2023 Document Fraud Report, 42 percent of fraudulent documents detected contain alterations to financial details.

“We’ve uncovered how very large credit losses can be caused by fraud within an application process alone,” McMeel said of the trend. “I think companies that aren’t really checking for this type of document fraud could be losing a lot of money in what they think is probably credit loss, as in bad underwriting. It’s actually preventable fraud loss, so it’s quite a good distinction there that they could be preventing.”

The challenge for financial services firms is forging ahead with attracting customers while tightening restrictions on lending money.

That’s where Inscribe’s prevention methods and detection technology can help. Using the problem-solving experience of manual review teams aided by the ever-expanding power of artificial intelligence, Inscribe’s fraud-detection process quickly analyzes billions of document data points accurately.

Inscribe’s completely automated process uses both document forensic detectors, which look at fonts, spacing, embedded texts and metadata within a document, and network detectors, which are based on data their AI models have come to learn and understand from an extensive network of documents.

“With our solution, we can see exactly where a document has been altered,” said McMeel.

Other aspects of the first-party fraud trend that Inscribe has been able to uncover through processing millions of applications each month include intelligence important to specific industries, such as:

- 50 percent of fraudulent small- and medium-sized business (SMB) loan application documents match the pattern of first-party fraud rather than third-party fraud.

- 30 percent of fraudulent personal loan application documents match the pattern of first-party fraud rather than third-party fraud.

Largest document database in industry

Rising first-party fraud is just one identifiable trend in Inscribe’s Document Fraud Report. The proliferation of fake and realistic documents is another along with the fake common documents from well-known institutions.

“Because we’ve been in the business of document fraud for so long now, we have the largest document database in the industry,” said McMeel. “This helps us identify, for example, a bank statement that, let’s say, has the same 100 transactions and the same 100 amounts that were seen six months before but had a different name and address associated with it.

“This is certainly something a manual reviewer would not be able to recollect because it’s just too much information, information that the human brain can’t recall. That’s where the value of our network-based detectives comes to fruition.”

Those network detectors give Inscribe and their customers a head start in the constant battle to stay ahead of fraud. Beyond manual review efforts, companies do try to develop their own in-house AI detection methods, but Inscribe’s experience and vast network capabilities provide an edge.

“In terms of why our tech might be in demand, I suppose it might be due to the fact that fraud prevention is always a cat-and-mouse game,” said McMeel. “Document fraud is the oldest technique in the fraudster playbook, and it’s probably not going away anytime soon, so as newer and more sophisticated methods of manipulation emerge, fraud teams need technology that specializes in racing fraudsters to the next form of fraud detection.

“That’s what we aim to do for our customers, and that’s what we’re currently doing for our customers. Staying one step ahead of the fraudsters is as always the aim of the game.”