Video games have remained strong amid pandemic restrictions, inflation, economic downturn, and the crypto winter. Seemingly in a world of its own, video game revenue grew by 32% between 2019 and 2021. It is expected to continue growing by 8.4% until 2026, creating a $321 billion industry.

Out of this growing market, the play-to-earn beast has risen its head. Now combining gameplay with the Web3 economics of crypto assets, there may be potential for significant disruption in the wealth creation sector.

“I think this is where the distinction happens. Why do people play games? Do they play for fun? Or do they play for economic rewards?” said Olya Caliujnaia, Co-Founder and CEO of Sanlo. “The historical precedent has been more of the former. Now there’s this new component where you can have economic gain.”

“Because of this, we’re seeing a new gaming population inflow. The incentives to play Web3 games around economic gains attract another segment of people.”

Sanlo recently partnered with Stardust to provide the framework for game and app developers to access financing and monetization opportunities in the Web3 space. Caliujnaia explains they hope to fund innovation in the space, enriching its development and potential for wealth creation.

Blockchain gaming economy resistant to bear market

It started with Axie Infinity, the single largest NFT project of all time, which combined gaming with the digital asset economy. Despite launching in 2018, it was not until the summer of last year that revenue skyrocketed for the Pokemon-esque game, reaching over $2 billion in NFT transaction volume and over $4 billion in market cap of its AXS governance token.

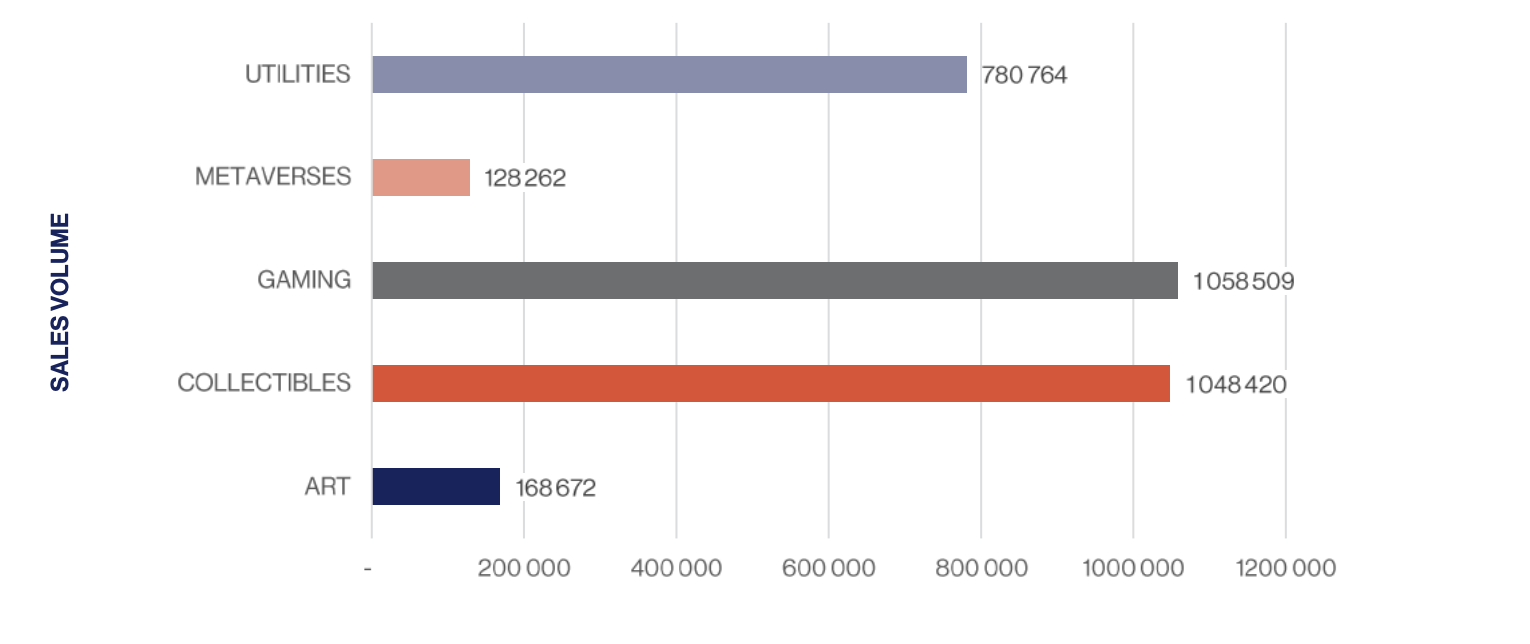

This has set the tone for play-to-earn. According to DappRadar, players spent $4.9 billion on NFTs in games last year. Although demand has slowed down since a peak last November, gaming NFT sales have continued to grow.

“Trading of gaming assets has been happening for years. Sometimes on official channels, sometimes through eBay and craigslist,” said Caliujnaia. “You can imagine where some things could go wrong, and Web3 technically can solve them.”

“There’s a potential of Web3 technology to be very applicable to gaming. That being said, in the gaming space, there are not that many Web3 projects that have launched just yet. Most of the NFT sales we’ve seen are not from games. The driving forces for trading are very different from those attached to a game and have a different buyer audience.”

This difference in motives has created a divide in the gaming community, Caliujnaia explained. However, she believes this is not unlike the divide at the beginning of the free-to-play mobile era of gaming. Like free-to-play, she sees a potential for play-to-earn adoption on a mass scale.

“We are not initiated into Web3’s jargon and Discord community. Most people don’t want to know the details of whether it’s on the blockchain or not. They just want to play the game. And if that game happens to have a crypto NFT component, but it does not interfere with your gameplay, then that’s great. The adoption happens very frictionlessly.”

“There is a lot of potential for future creator monetization and wealth creation for gamers,” she said.

Video games could be a key component in crypto adoption

Cryptocurrency adoption is steadily increasing, but for some sources, confusion around terminology is a significant barrier to mass adoption. Integration of crypto assets into gaming could bridge this gap.

“Gaming has the potential to engage more consumers that are not financially savvy traders, into wealth creation and crypto adoption, in a more frictionless way because it becomes part of that gameplay,” continues Caliujnaia.

Gamification has been used for years in the finance industry to make financial services more accessible, many believing it to be a critical component in improving financial inclusion. It seems access to wealth creation through digital assets may be no exception.

“I think part of our job as an industry is to actually make it so that digital asset components become part of the common language,” she concluded.

Related:

The post Play-to-Earn: crypto wealth creation amid a downturn? appeared first on News.