The final part of the IPCC’s sixth extensive Assessment Report has been published with a sobering warning for the climate crisis – it’s now or never.

The UN secretary general, António Guterres, said, “This report is a clarion call to massively fast-track climate efforts by every country and every sector and on every timeframe. Our world needs climate action on all fronts: everything, everywhere, all at once.”

Finance is seen to be a driving force for environmental action, with investment shaping the activities of many institutions worldwide. Despite the controversy surrounding ESG ratings, the masses have expressed interest in sustainable investing mounting every year.

ESGs have faced criticism recently due to the lack of clarity and standardization surrounding ratings. Firms that score high in one aspect can score terribly in others and still maintain a positive outcome.

Companies have monetized the public focus toward sustainable practices without implementing the necessary measures to make an impact.

Transparency has become paramount, providing some antidote to the greenwashing facing investors. However, results have been mixed, and the landscape remains difficult for the conscious investor to navigate.

Providing transparency for impact investors

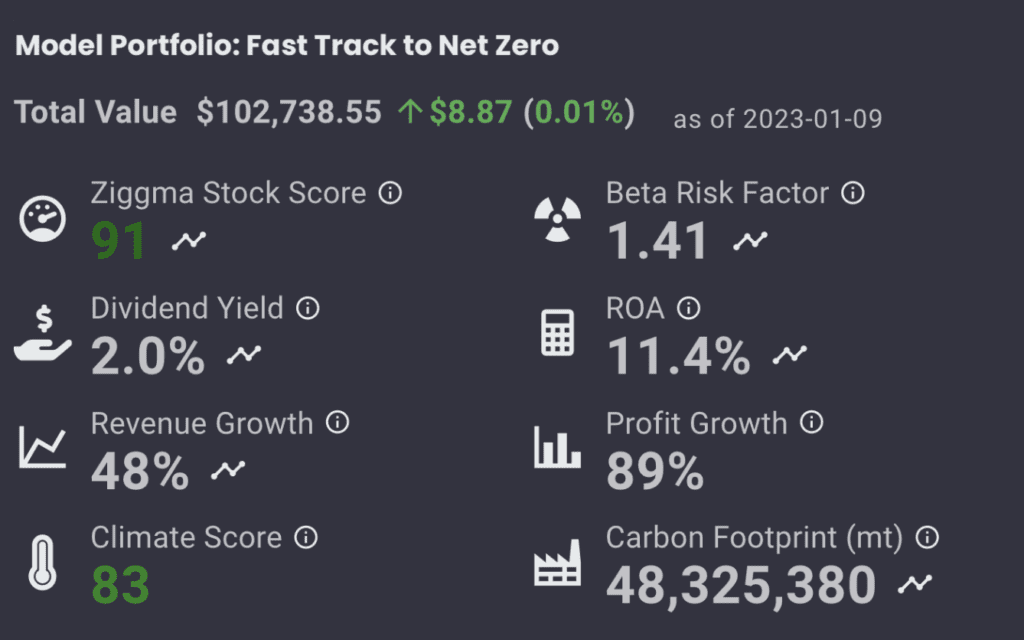

“If you really boil it down to the basics, investors are no longer content with just positive returns. They also want to have a tangible positive impact with the money, especially the younger crowd,” said Ulrich Ebensperger, CEO of Ziggma. “Right now, it’s a challenge to combine the two.”

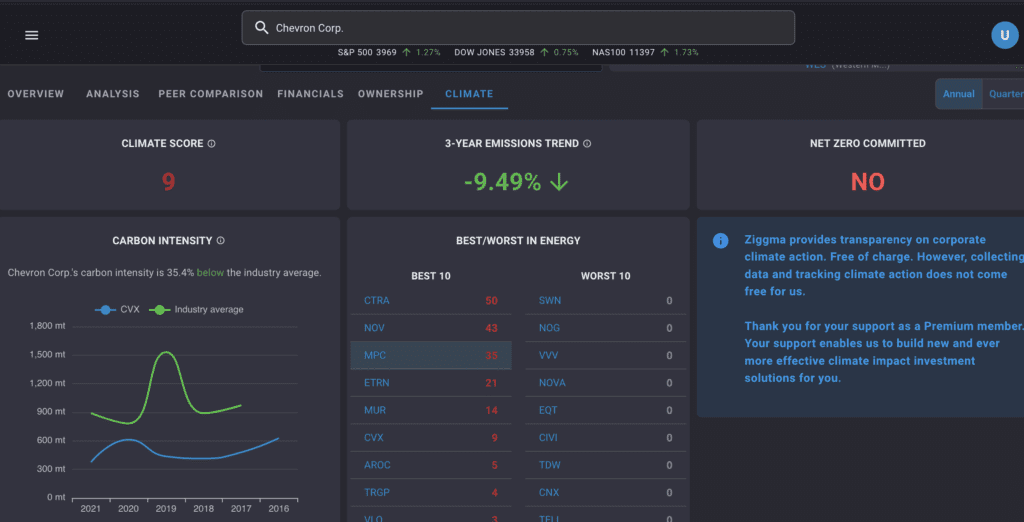

Ziggma is positioned to help this, providing a dashboard that shows in-depth financial data and demonstrates the climate impact of firms. Investors can visit the dashboard to check the performance of individual investments or plug in their complete online investment portfolios.

“Most of our clients are connecting Robinhood accounts to our application. ” They want better tools and become more serious about their investments,” continued Ebensperger.

“An investor who wants to manage his portfolio independently can come to Ziggma and get good stock research information as well as information on a company’s track record or cutting emissions and its ambitions.”

Related:

The company provides a score based on an assessment of the active operations of each company, shying away from announcements of intended actions taking place in the future.

He explained that in recent years, many businesses heralded for their trailblazing efforts in climate impact still had increased their carbon intensity.

“You look at the sustainability report that they publish, questioning how they will get to the point where they will eliminate all of their historical emissions by 2050. And it’s really all with offsets.”

“The big focus should be on what they are actually doing, rather than what are they hoping or anticipating to do in the future,” said Ebensperger. “First of all, that’s the future we have to act now. And secondly, there’s a lot of uncertainty attached to that.”

He explained that the platform informs investors of proxy voting announcements, encouraging them to use their voting rights.

“Divesting is not the solution. You can stay in utilities, supporting the ones that are really acting, which is what the Ziggma climate score is for. Or, even better, you don’t sell your shares, but you vote your shares when there are climate impact resolutions on the proxy voting.”

He said that currently, only 11% of investors in the US vote on resolutions, leaving a lot of room for impacting corporate practices. “If we get that to 30%, then we have 20 million people voting, and I think companies will take note.”