A New York Fed report released this morning shows Americans leaned heavily on their traditional credit cards in June to offset growing financial pressures from inflation.

The Washington Post reported that it was the biggest monthly increase in credit card spending in 20 years.

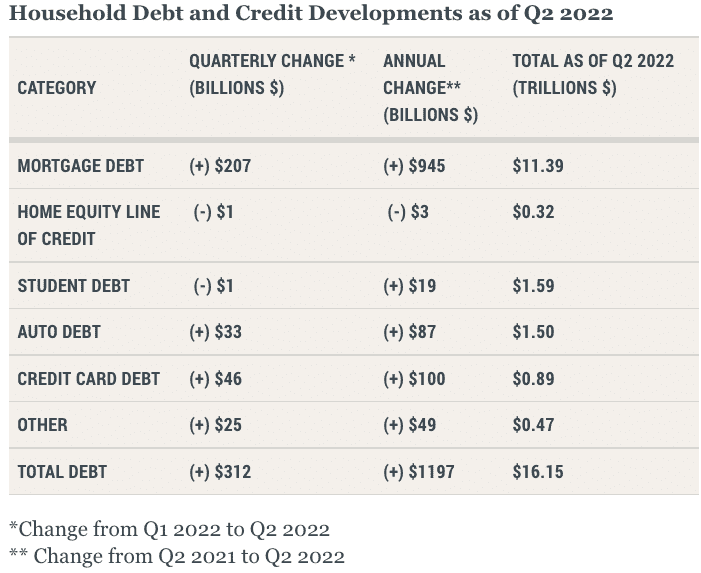

The NY Fed report shows an increase in total household debt in the second quarter of 2022, increasing by $312 billion (2%) to $16.15 trillion. The report stated that balances now stand $2 trillion higher than at the end of 2019, before the COVID-19 pandemic.

The Fintech Nexus News team is working on expanding this story to uncover the impacts and implications for fintech. We will update the story as we gather analysis from our roster of topic experts.

The post Americans leaned heavily on credit card crutches in June as inflation surged appeared first on News.